When it comes to online shopping, understanding the fine print is crucial—especially regarding credit card use. Terms and conditions (T&C) act as a safety net for both you and your customers, ensuring that everyone’s clear on what to expect. They set the rules of engagement and help prevent misunderstandings, making the online shopping experience smoother and more secure. In this section, we’ll dig into what these terms include and why they matter for your ecommerce website.

Importance of Terms and Conditions in Ecommerce

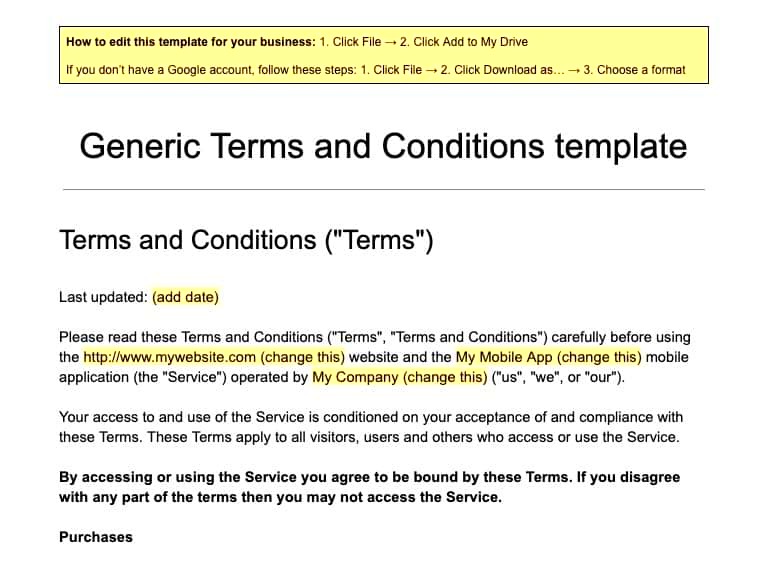

So, why should you even bother crafting comprehensive terms and conditions for credit card use on your ecommerce site? Well, let’s break it down:

- Legal Protection: Having a robust T&C document helps protect your business legally. It outlines your policies and shields you from potential disputes.

- Customer Clarity: T&Cs provide transparency to customers. They help shoppers understand what happens when they make a purchase, including payment processing, refunds, and chargebacks.

- Building Trust: A well-crafted T&C statement can instill confidence in customers. When they see you take the time to be clear and upfront, they’re more likely to trust your brand.

- Compliance: Adhering to legal requirements related to credit card transactions is vital. Your T&C can help ensure you’re following regulations like PCI compliance.

Here’s a quick look at sections commonly included in credit card terms:

| Section | Description |

|---|---|

| Payment Methods | Details on acceptable credit card types and other payment options. |

| Authorization | Explains how transactions are authorized and processed. |

| Refunds and Returns | Outlines the refund process and conditions for returns. |

| Security Measures | Discusses how customer data is protected during transactions. |

In short, having clear terms and conditions for credit card use is not just a legal requirement; it’s a fundamental part of creating a reliable and trustworthy shopping experience online.

Key Components of Terms and Conditions

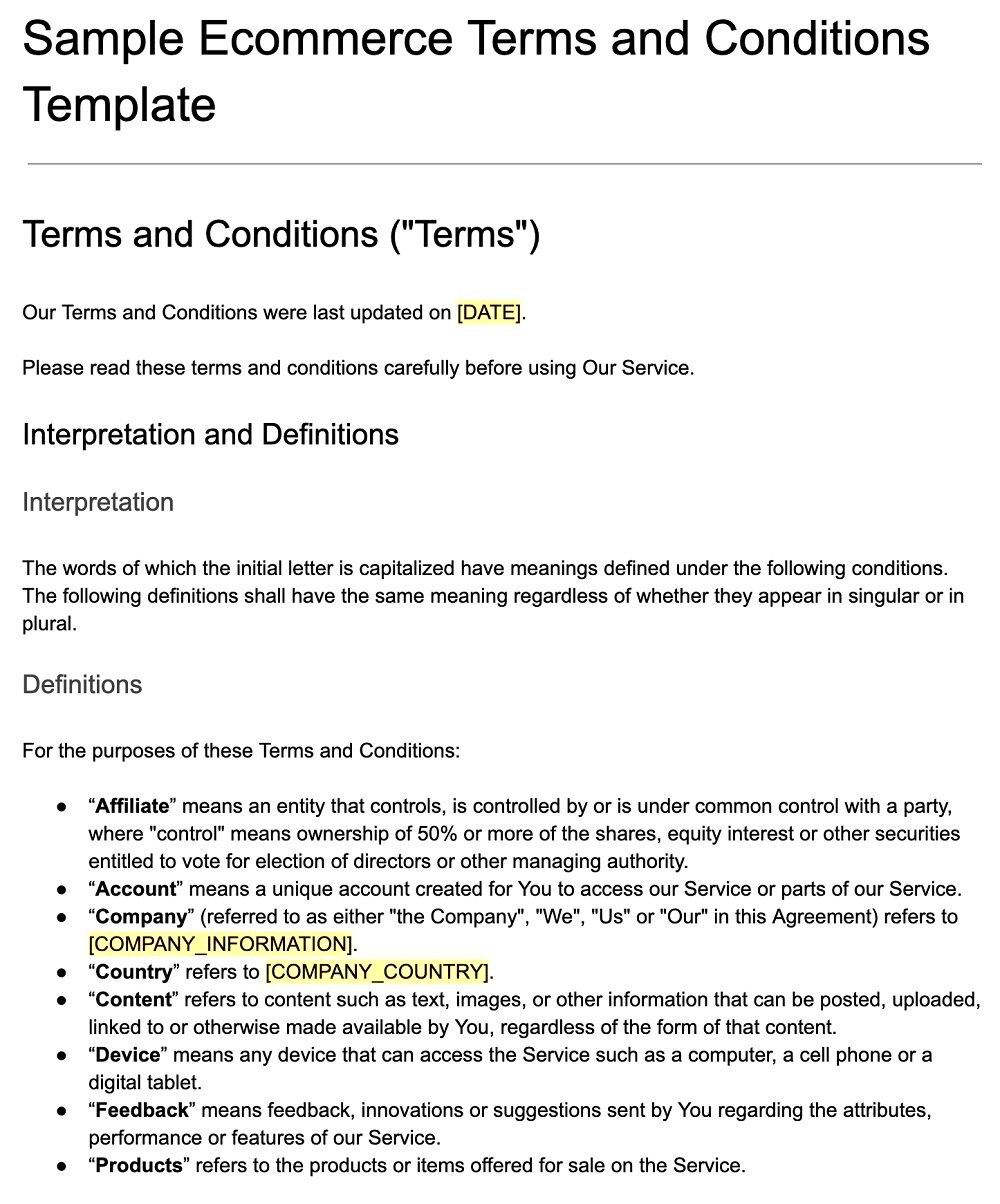

Crafting the Terms and Conditions for credit card use on eCommerce websites is crucial for protecting both the business and its customers. The following key components are essential in creating a comprehensive and user-friendly document:

- Introduction: Start with a brief explanation of the purpose of the Terms and Conditions. Make it clear that entering the site and using credit card facilities implies acceptance of these terms.

- Definitions: Clearly define key terms to avoid ambiguity. This includes terms like “User,” “Transaction,” “Service,” and “Payment Processor.”

- User Responsibilities: Outline the responsibilities of users when making transactions. This could include providing accurate information, maintaining the confidentiality of account details, and complying with all applicable laws.

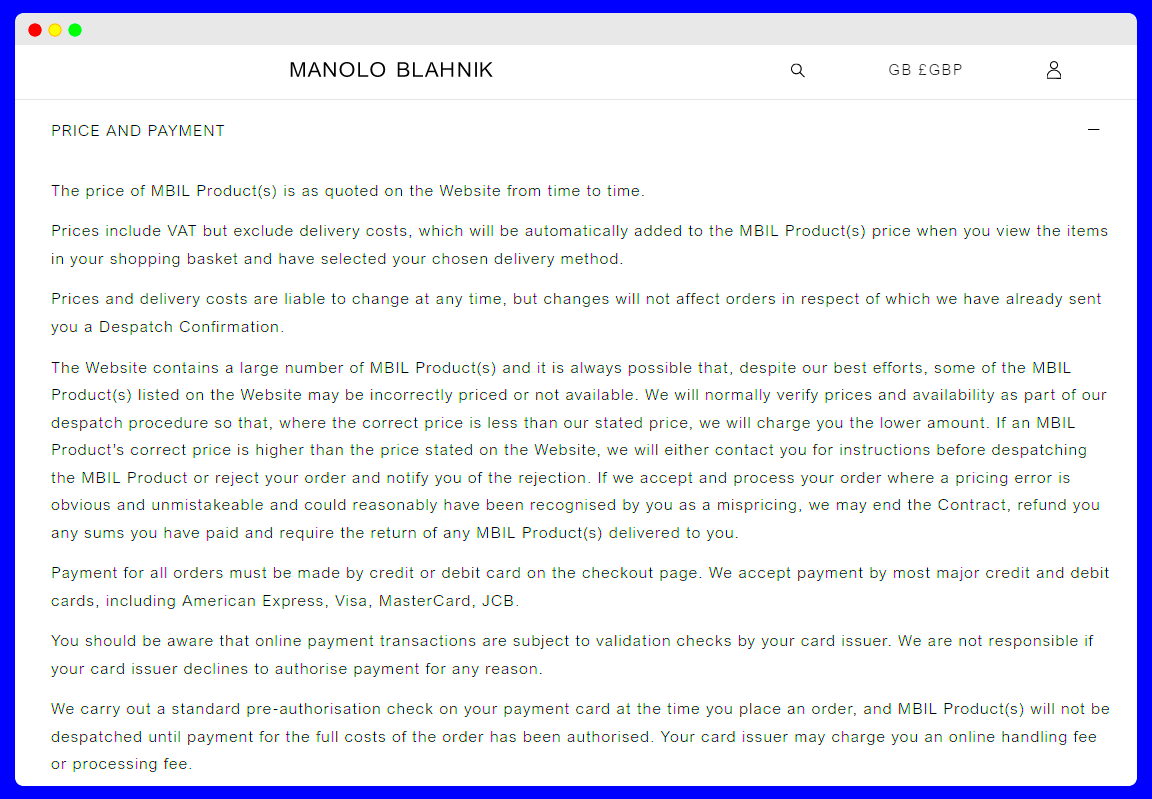

- Payment Terms: Describe payment procedures, including accepted payment methods, the timing of charges, and currency specifications. It’s crucial to also include information on when a transaction might fail or be refunded.

- Dispute Resolution: Detail the procedures for resolving disputes. Encourage users to contact customer service first and outline the steps they should follow if issues arise.

- Liabilities and Limitations: Clearly state any limitations on liability regarding the use of credit card services. This helps protect the company from claims stemming from processing errors.

- Modifications to Terms: Include a clause about your right to update the Terms and Conditions. Notify customers on how they can stay informed about changes, which could include mailing lists or website alerts.

By including these components in your Terms and Conditions, you not only establish clear guidelines for users but also demonstrate a commitment to transparency and user accountability.

Legal Requirements for Ecommerce Sites

When setting up Terms and Conditions for credit card use on eCommerce websites, it’s vital to ensure compliance with legal requirements to avoid penalties and enhance customer trust. Here are some critical legal considerations:

- Consumer Protection Laws: Depending on your location, eCommerce businesses must comply with various consumer protection laws that safeguard customers against fraud and unfair practices. Familiarize yourself with these regulations to ensure compliance.

- GDPR and Privacy Laws: If selling to consumers in the EU, you must adhere to the General Data Protection Regulation (GDPR). Make sure your Terms and Conditions include information on how customer data will be used and stored, along with users’ rights to access their data.

- PCI DSS Compliance: If your site processes credit card transactions, you need to comply with the Payment Card Industry Data Security Standard (PCI DSS). This ensures that you are protecting cardholder information and mitigating the risk of data breaches.

- Electronic Signatures: Ensure that your Terms and Conditions are legally binding by including clauses that allow electronic acceptance. This means users must actively agree to the Terms before completing a transaction.

- Jurisdiction: Specify the legal jurisdiction that governs your Terms and Conditions. This helps clarify where any legal disputes will be settled and under which laws.

It’s crucial to stay current on eCommerce regulations, which can change frequently. Consult with a legal expert to help you navigate these requirements and tailor your Terms and Conditions accordingly, ensuring your eCommerce site operates within the law while fostering customer confidence.

Best Practices for Writing Clear and Concise Terms

When it comes to crafting Terms and Conditions for credit card use on eCommerce websites, clarity is key. Your customers might not have a law degree, so it’s vital to keep things simple. Here are some best practices you might find helpful:

- Use Plain Language: Avoid legal jargon. Instead, communicate in straightforward language that anyone can understand.

- Be Specific: Clearly outline what your terms cover. If you’re discussing payment methods, specify accepted cards, payment processing fees, and security measures.

- Organize Logically: Structure your document with clear headings and bullet points. This makes it easier for readers to navigate. For instance:

| Section | Content Description |

|---|---|

| Acceptance of Terms | Clearly state that using the site means accepting the terms. |

| Payment Terms | Outline payment methods, timing, and security. |

| Refund Policy | Provide information regarding refunds and processing timeframes. |

Use Examples: Where applicable, include examples to clarify complex points. This can help demystify the terms and conditions.

Review and Revise: Terms and Conditions aren’t a ‘one and done’ document. Regularly review and update them as your business practices or laws change.

Incorporating these best practices will not only enhance the transparency of your terms but also foster trust with your customers. When they feel informed, they’re more likely to complete a purchase.

Common Pitfalls to Avoid When Crafting Terms and Conditions

Writing Terms and Conditions might seem straightforward, but it’s easy to stumble into some common traps. Here are a few pitfalls that you definitely want to steer clear of:

- Using Vague Language: Avoid ambiguity. Words that are open to interpretation can lead to misunderstandings. Be as precise as possible to ensure your customers know what to expect.

- Overloading with Legalese: As mentioned earlier, using complicated legal jargon can alienate your customers. Simplifying the language will help keep them engaged.

- Ignoring Local Laws: Make sure that your terms comply with local and international regulations. For example, different countries have different rules about consumer protection and privacy.

- Neglecting Updates: Failing to update your Terms and Conditions can lead to inconsistencies. As your business evolves, so should your policies.

- Overlooking the User Experience: Don’t bury your Terms and Conditions in fine print. Make them accessible and easy to find. Consider having a summary or FAQ section to answer the most common queries.

Not Providing Contact Information: Failing to offer a way for customers to reach out with questions can create frustration. Include contact details for customer support related to your terms.

By avoiding these pitfalls, you’ll be on your way to creating comprehensive and user-friendly Terms and Conditions that not only protect your business but also enhance customer trust.

How to Ensure Compliance with Payment Regulations

When running an eCommerce website that accepts credit card payments, ensuring compliance with payment regulations is not just a matter of ticking boxes; it’s about building trust and credibility with your customers. The world of online payments is fraught with rules and regulations that can feel overwhelming. However, by breaking it down into manageable steps, you can create a framework that ensures you stay compliant.

First and foremost, it’s critical to be aware of the major regulations that govern online payments. The Payment Card Industry Data Security Standard (PCI DSS) is one such regulation. Compliance with PCI DSS is mandatory for any business that accepts credit cards. It includes guidelines for data encryption, secure storage, and maintaining a secure network, among other things.

Another key regulation to watch out for is the General Data Protection Regulation (GDPR) for businesses operating within the EU or dealing with EU customers. This regulation emphasizes data protection and privacy. Ensure that your website collects personal data legally, and provides transparent information about how you use that data.

To ensure compliance, consider implementing the following actions:

- Conduct Regular Audits: Regularly audit your practices and policies to make sure they’re compliant with regulations.

- Training and Education: Train your team on payment regulations and the importance of compliance.

- Stay Updated: Regulations are constantly evolving. Make it a routine to stay updated on any changes.

- Seek Legal Consultation: Sometimes, consulting with a legal expert can save you from future complications.

By taking these steps, you can create a secure and compliant environment for your customers, making the online shopping experience safe and enjoyable.

Providing User-Friendly Guidelines for Customers

Let’s face it: shopping online should be easy and enjoyable. When people visit your eCommerce site, the last thing they want is to navigate through complex and jargon-filled legalese. This is where user-friendly guidelines come into play. They not only educate your customers but also help in minimizing misunderstandings and disputes.

Start by simplifying the language you use in your Terms and Conditions. Instead of using technical jargon, opt for straightforward explanations. For instance, rather than saying, “The retailer shall not be liable for any indirect, incidental, special, consequential, or punitive damages…,” you might say, “If something goes wrong with your order, we are here to help, but we aren’t responsible for losses beyond your purchase.”

Moreover, it’s essential to clearly outline the following:

- How to Use Your Credit Card: Explain the steps customers need to follow to make payments, including how to enter their card details safely.

- Return and Refund Policies: Provide clear instructions on how customers can return items and obtain a refund.

- Data Protection Measures: Reassure customers about how their personal information is managed and protected.

- Customer Support Channels: Make sure to inform them about how they can get help if they encounter an issue.

A great way to make this information more engaging is to utilize visuals like infographics or short videos. Consider adding a FAQ section at the end that anticipates common questions and concerns. This way, your customers can feel confident and informed, enabling a smoother shopping experience.

9. Regularly Updating Terms and Conditions

When it comes to the digital landscape, change is the only constant. That’s why regularly updating your terms and conditions is not just a good practice; it’s essential. E-commerce businesses must keep their policies in sync with the ever-evolving regulations, technology, and consumer expectations. Here’s what you should consider:

- Stay Compliant: Laws and regulations around credit card use can change, especially regarding consumer protection. Regular updates ensure you comply with any new legislations.

- Reflect Business Changes: As your e-commerce platform evolves, so do your products, payment methods, or services. Update your terms to reflect these changes accurately.

- Address Consumer Feedback: If customers frequently raise concerns or questions about certain aspects of your terms, it’s a sign that clarity is needed. Regular reviews can help address these issues.

- Enhance Transparency: Regularly revisiting your terms not only encourages transparency but also demonstrates your commitment to customer rights.

Regular updates don’t just protect you legally; they build customer trust. When customers notice that a business is proactive in keeping its policies current, they tend to feel more confident in their transactions. Remember to communicate any changes clearly, ideally allowing time for customers to read and understand the updated terms.

10. Conclusion: Creating Trust Through Transparent Policies

In the bustling world of e-commerce, building trust is paramount. Your terms and conditions act as the foundation of this trust, especially when credit card transactions are involved. Here’s why transparent policies matter:

- Clear Communication: A well-crafted set of terms makes your policies clear and accessible. It answers potential questions and mitigates misunderstandings.

- Consumer Confidence: By being upfront about fees, liabilities, and regulations, you foster a sense of security among customers. Confidence in the purchasing process often translates into repeat business.

- Brand Reputation: Businesses known for their transparency often enjoy a better reputation. Happy customers regularly recommend these businesses, enhancing your word-of-mouth marketing.

Ultimately, transparent terms and conditions are not just legal jargon; they’re a crucial part of your relationship with your customers. By approaching this aspect of your e-commerce strategy earnestly, you not only comply with regulations but also foster a loyal and trusting customer base. Remember, trust takes time to build, but transparent policies can help you achieve it more swiftly!