When diving into the world of e-commerce, especially with WooCommerce, one of the burning questions is whether there are limits on transaction prices. WooCommerce, a powerful WordPress plugin, provides a flexible platform for selling products and services online. However, as you push higher and higher with your pricing, it’s essential to understand the potential boundaries that could affect your transactions. Let’s break this down so you can shop easily and without worry.

Understanding WooCommerce Transaction Pricing Structure

WooCommerce itself does not impose a strict limit on the price of transactions, meaning you’re free to set prices as high as your market allows. However, there are several factors and components that can influence your overall transaction pricing:

- Payment Gateway Limitations: Different payment gateways (like PayPal, Stripe, etc.) may have their own transaction limits. For example, some gateways might restrict transactions to a specific amount to prevent fraud.

- Merchant Account Restrictions: If you’re using a payment processor, they may impose limits based on your account tier. Higher transaction amounts may require higher verification levels.

- Tiers and Fees: As transactions get larger, fees often increase. Be mindful of how cumulative fees from gateways can affect profitability.

- Risk and Fraud Prevention: Some payment processors flag large transactions for additional review, prolonging the transaction process and potentially causing customer frustration.

- Currency Constraints: Depending on the currency you’re using, there may be specific constraints that can act as a limit on high-value transactions.

Ultimately, it’s crucial to choose a payment gateway that can accommodate your pricing strategy and ensure seamless transactions for your customers. Understanding these components will empower you to set pricing that meets both your business goals and customer expectations without the worry of hitting a wall.

Factors Influencing Price Limits in WooCommerce

When it comes to WooCommerce, several factors can influence the price limits set for transactions. Understanding these factors is crucial for both store owners and customers. So, let’s dive into what those factors are!

- Payment Gateway Restrictions: Different payment gateways have distinct policies and limitations when processing transactions. For example, PayPal or Stripe might impose certain upper limits depending on the type of account a merchant has. Knowing the specific restrictions of your chosen gateway is key to setting realistic price limits.

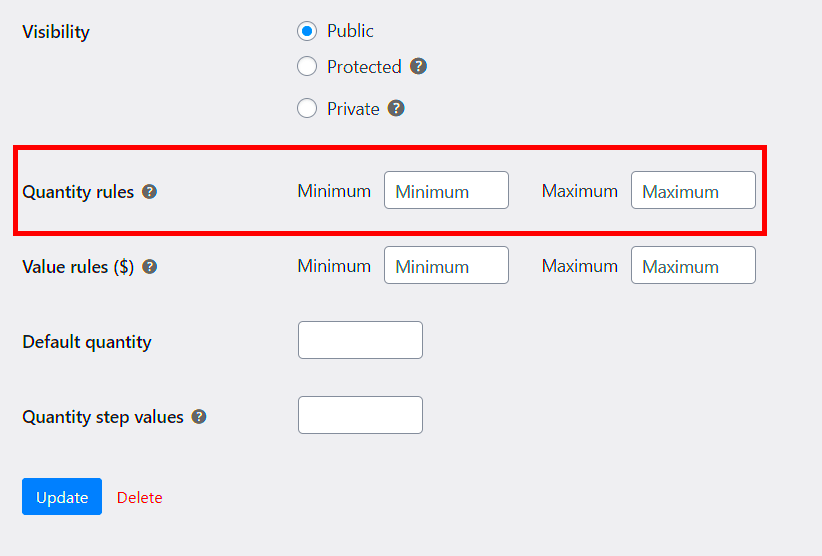

- Store Configuration: Sometimes, the store configuration itself can influence what customers can spend. For instance, WooCommerce allows store owners to set minimum and maximum spending amounts for specific product categories or overall store transactions. This can directly impact how much a customer can check out with.

- Customer Type: It’s not uncommon to differentiate between regular customers and wholesale or business accounts. In many cases, you might want to offer different purchasing limits based on the customer’s profile. This flexibility can help tailor the shopping experience for various segments.

- Currency and Region Variations: The currency being used and the region where the store operates can also dictate price limits. In regions with economic fluctuations or specific regulations, there may be limits to ensure compliance with local laws.

- Technical Constraints: Plugins and custom themes can sometimes introduce challenges when it comes to setting transaction limits. For example, if there’s a glitch or compatibility issue, limits may not work as intended, leading to customer frustration.

Default Transaction Limits in WooCommerce

WooCommerce does come with default settings that can impact transaction limits right out of the gate. Understanding these defaults is essential for ensuring a smooth shopping experience. Here’s a breakdown of the typical default limits you’ll find:

| Parameter | Default Limit |

|---|---|

| Minimum Order Amount | $0.00 (no minimum) |

| Maximum Order Amount | No set limit; depends on payment gateway |

| Maximum Quantity per Product | Typically set at 100 (can vary) |

| Order Total Limit by Payment Gateway | Varies; check your payment gateway settings |

While WooCommerce provides flexibility in transaction amounts, it’s essential for store owners to review and customize these values according to their business model. Also, periodically checking for updates and changes in gateway policies can help avoid surprises during transactions!

How Payment Gateways Affect Transaction Limits

When it comes to managing transactions in WooCommerce, payment gateways play a crucial role. Each payment provider has its own set of rules and limitations that can either facilitate or hinder your transactions. Understanding how payment gateways operate is key to navigating any limits they might impose on transaction sizes.

One major factor to consider is the type of payment gateway you choose. Some gateways are more familiar with high-value transactions, while others may have strict restrictions. Here are a few important points:

- Transaction Limits: Many gateways set predefined limits on the amount you can process per transaction. These limits can vary significantly—from a few hundred dollars to tens of thousands. For instance, PayPal might allow you to process $10,000 in a single transaction, whereas others may cap at much lower amounts.

- Chargeback Policies: Higher transaction amounts can lead to increased risks for payment gateways. As a result, they may impose stricter chargeback policies, which could mean that large payments are scrutinized more closely.

- Merchant Account Type: Depending on whether you have a standard or a merchant account, you may experience different transaction limits. Merchants with a good track record often qualify for higher limits.

In conclusion, it’s essential to research your payment gateways and understand their limitations and policies. By doing so, you can select the one that aligns best with your WooCommerce store’s needs and plan your pricing strategies accordingly.

Strategies to Manage High-Value Transactions in WooCommerce

Managing high-value transactions in WooCommerce doesn’t have to be a daunting task. With the right strategies in place, you can streamline the process, ensure security, and maintain customer trust. Here are several effective strategies:

- Customer Verification: Implement multi-factor authentication and email verification processes. This adds an additional layer of security, making customers feel more secure while dealing with high-value transactions.

- Transaction Splitting: If a payment gateway has a cap on transaction amounts, consider splitting the total into multiple smaller transactions. This allows you to circumvent limitations while processing high-value orders more effectively.

- Custom Payment Solutions: For businesses frequently dealing with larger transactions, exploring custom solutions or integrating with payment gateways that specialize in high-value transactions can be beneficial.

- Regular Monitoring: Keep an eye on transactions to spot anomalies. Leveraging WooCommerce’s built-in reporting features can help in tracking customer behavior and transaction patterns.

- Communication with Payment Gateways: Establishing a good relationship with your payment processor can be invaluable. They may provide insights tailored to your specific needs, such as increasing transaction limits based on your sales history.

By adopting these strategies, you can not only manage high-value transactions efficiently but also create a seamless shopping experience that reassures your customers and drives sales in your WooCommerce store.

7. Best Practices for Handling Transactions Above Set Limits

When managing an online store with WooCommerce, it’s essential to have a solid strategy for handling transactions that exceed established price limits. Here are some best practices to ensure that your customers enjoy a seamless shopping experience even with higher-value purchases:

- Communicate Clearly: Always inform your customers about any price limits upfront. This transparency can be achieved through FAQs, terms and conditions, and during the checkout process. Consider highlighting this information in your product descriptions or in a banner on your homepage.

- Payment Gateway Review: Not all payment gateways have the same transaction limits. Some may impose stricter limits than others. It’s crucial to choose a payment gateway that aligns with your needs. Research options and their limits so that you can be proactive in setting prices for your products.

- Pre-authorization Feature: For high-ticket items, consider using a pre-authorization feature. This allows you to confirm that the cardholder has sufficient funds without immediately charging their account, reducing the risk of declining transactions.

- Bulk Purchase Discounts: Offering discounts for bulk purchases can be a win-win for both you and your customers. If a customer wants to buy multiple items that together exceed the transaction limit, why not offer a deal? This encourages sales while keeping transactions manageable.

- Alternative Payment Methods: Providing multiple payment options can help avoid issues with transaction limits. For instance, services like PayPal or Klarna may have different thresholds and can be a feasible alternative for higher amounts.

- Regular System Checks: Regularly audit your WooCommerce settings and your payment processors to ensure your limits are current. This helps prevent surprises that might hinder a customer’s purchasing experience.

8. Conclusion: Navigating Transaction Limits in WooCommerce

Navigating transaction limits in WooCommerce doesn’t have to be a headache. With the right strategies and a bit of foresight, you can ensure that even high-value transactions go smoothly and efficiently. Remember, the ultimate goal is to provide your customers with an excellent shopping experience while minimizing the risk for your business.

So, what can we take away from this?

- Know Your Limits: Understand both your own product limits and those imposed by your payment processors.

- Communicate Effectively: Clear communication can prevent frustration for both you and your customers.

- Stay Flexible: Being open to alternative payment methods can make all the difference when dealing with larger transactions.

- Plan Ahead: Using practices like bulk purchasing rules and pre-authorization can mitigate potential problems.

As you continue to grow your WooCommerce store, keep these best practices in mind! Having measures in place to handle transactions above set limits not only protects your business but also fosters customer loyalty. Happy selling!