WooCommerce has become a go-to platform for many Canadians looking to set up an online store. But as exciting as this journey can be, it’s essential to understand the fees and charges that come along with it. These costs can vary and impact your bottom line significantly. In this section, we’ll give you an overview of what fees you might face and the importance of being aware of them when starting your eCommerce adventure.

Understanding the Cost Structure of WooCommerce

When diving into WooCommerce, grasping the cost structure is crucial for budgeting effectively. Here’s a breakdown of the main fees and charges you should be aware of:

- Hosting Fees: Your online store needs a home, and that’s where web hosting comes in. Depending on your hosting provider, this can cost you anywhere from $5 to $50 per month, or even more!

- Domain Registration: You can’t have your website without a domain name. Typically, this costs around $10 to $20 annually.

- WooCommerce Plugin: The core WooCommerce plugin is free, but you may want to purchase additional plugins for added functionality, ranging from $30 to $300 each.

- Payment Gateway Fees: Each payment gateway, whether it’s PayPal, Stripe, or another provider, charges transaction fees. Expect to pay around 2.9% + $0.30 per transaction, which can add up!

- Themes and Customization: A great-looking store can be achieved through a premium theme (usually $30 to $100) or hiring a developer for customization, which can be a one-time fee or ongoing costs.

- Maintenance and Upgrades: Regular updates and maintenance can involve costs. A maintenance plan could run you between $30 to $100 a month.

By understanding these components of WooCommerce fees and charges, you’ll be better prepared to manage your finances and set your eCommerce business up for success in Canada!

Transaction Fees: What You Need to Know

When you’re running an online store in Canada using WooCommerce, it’s crucial to get a grasp on transaction fees. These fees can sneak up on you and eat into your profits if you’re not careful. So, what exactly are transaction fees?

Transaction fees are charges that payment processors impose for handling each sale you make. This is usually a percentage of the transaction amount, combined with a fixed fee for every transaction. The exact fee can vary based on the payment gateway you choose. Here’s a quick rundown of what you should keep in mind:

- Percentage Fees: Most gateways charge a percentage of the total sale, typically ranging from 1.4% to 3%.

- Fixed Fees: In addition to percentage fees, many payment processors also charge a flat fee for each transaction, which can range from $0.25 to $0.50.

- Currency Conversion: If you’re selling internationally, watch out for currency conversion fees, which can add another layer of cost.

- Monthly Fees: Some payment processors may charge a monthly fee, regardless of your sales volume.

It’s important to read the fine print with any payment processor. Remember, those tiny fees can add up quickly! Additionally, keep an eye on how fees scale with your growing business—some gateways are more cost-effective as your sales increase, while others may not be as forgiving.

Payment Gateway Fees for Canadian Businesses

Choosing a payment gateway is a significant decision for Canadian businesses using WooCommerce, and it’s not just about the overall user experience—fees play a crucial role too. Each gateway comes with its own fee structure, and understanding these can mean saving a lot of money over time.

Here are some common payment gateways used by Canadian businesses along with their typical fee structures:

| Payment Gateway | Transaction Fee | Fixed Fee | Notes |

|---|---|---|---|

| PayPal | 2.9% + 0.30 CAD | 0.30 CAD | Widely recognized, good for international sales. |

| Stripe | 2.9% + 0.30 CAD | 0.30 CAD | Integrates well with WooCommerce, no monthly fees. |

| Square | 2.65% (online) | 0.00 CAD | Simple structure, ideal for small businesses. |

| Authorize.Net | 2.9% + 0.30 CAD | 0.30 CAD | Great security features and extensive integrations. |

When selecting a gateway, consider not just the fees but also the features offered. Some gateways provide additional services like fraud prevention, analytics, or even customer support. Think about what you need for your specific business to find the best fit.

Lastly, always keep an eye on any changes in fee structures or new players in the market—sometimes, switching providers can lead to substantial savings!

Shipping and Handling Charges

When you’re running an online store in Canada using WooCommerce, one of the first things you’ll need to tackle is shipping and handling charges. These costs can make or break your sales, so understanding how they work is crucial.

Shipping costs typically fall into a few different categories:

- Flat Rate Shipping: This is a set fee that you charge for shipping, regardless of the size or weight of the order. It’s straightforward and can work well if most of your orders are similar.

- Weight-Based Shipping: With this method, costs are determined by the weight of the items being shipped. If you sell heavier products, this option could better match actual shipping expenses.

- Free Shipping: This popular choice can entice customers, but you’ll need to absorb the costs somehow. One strategy is to offer free shipping on orders over a certain amount.

Additionally, don’t forget to consider handling charges. These are fees added to cover packaging and labor costs and can be a percentage of the total order or a flat fee. Here’s a quick table to illustrate some common shipping and handling fee structures:

| Method | Advantages | Drawbacks |

|---|---|---|

| Flat Rate Shipping | Simple to calculate, predictable costs. | May not cover costs for heavier items. |

| Weight-Based Shipping | More accurate reflection of shipping costs. | Can be complex to calculate. |

| Free Shipping | Attracts customers and increases conversion rates. | Can cut into profit margins. |

In sum, whatever strategy you choose, be sure to analyze your costs and customer behavior to find that sweet spot that maintains your profit without driving away potential buyers.

Taxes and Compliance Costs in Canada

Let’s face it—navigating taxes and compliance can throw a wrench in the smooth operation of your WooCommerce store. In Canada, the tax landscape is particularly intricate, consisting of federal and provincial taxes that can vary significantly by region.

Here are the two main types of taxes you need to be aware of:

- Goods and Services Tax (GST): This is a federal tax that applies universally across Canada at a rate of 5%. This is the basic level you’ll need to layer into your pricing.

- Provincial Sales Tax (PST): Different provinces have their own sales taxes, ranging from 0% to around 10%. For example, British Columbia has a Provincial Sales Tax of 7%, but Alberta has no PST at all.

You also have to think about the Harmonized Sales Tax (HST), which is a blend of GST and PST and is applied in some provinces. That’s right, depending on where you’re selling, you might need to collect varying rates of taxation from your customers.

Now, let’s not ignore compliance costs associated with remaining in good standing with tax authorities:

- Filing Fees: You may incur costs for hiring accountants or using tax software to file returns, which can add up over time.

- Legal Fees: Consulting with tax professionals will ensure compliance but can also mean extra expenses.

Keep in mind that keeping track of these taxes isn’t just a ‘nice to have’; it’s a must. Not managing them correctly can lead to hefty penalties, which is the last thing any small business owner needs. Stay organized, seek out resources to help, and always be in the loop on regional tax updates to make sure your WooCommerce store remains a thriving asset!

Additional Costs: Plugins and Themes

When you’re setting up your WooCommerce store, the cost of the platform isn’t just about the basic fees you might be paying. Additional costs can sneak in under the radar, especially when we talk about plugins and themes. These elements are essential for enhancing your site’s functionality and overall aesthetic, but they can also create a significant dent in your budget if you’re not careful.

WooCommerce itself is free, but just like icing on a cake, plugins and themes add that delectable touch that can enhance the online shopping experience for your customers.

So, what should you consider regarding additional costs? Here’s a simplified breakdown:

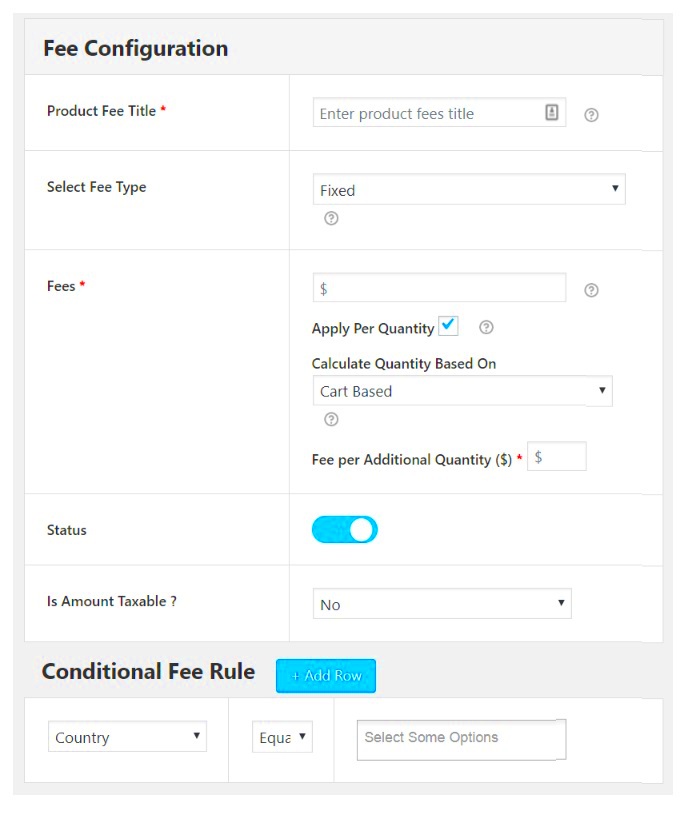

- Plugins: These are essential tools that add specific functionalities to your store. For instance, if you want your customers to have a seamless checkout experience, you might need to invest in premium payment gateway plugins. Prices can vary widely, often ranging from $30 to over $500 depending on the complexity and support provided.

- Themes: While free themes are available, investing in a premium theme can offer unique designs and customizable features. Premium themes might cost anywhere from $40 to upwards of $100.

- Maintenance Costs: Plugins and themes need regular updates to stay compatible with WooCommerce. This can lead to additional costs if you require professional maintenance services.

In conclusion, while building a WooCommerce store in Canada, it’s crucial to budget not just for the basic platform costs but also for the plugins and themes that make it shine. Plan your expenses wisely to avoid any nasty surprises later on!

Strategies to Minimize WooCommerce Fees

Keeping a tight grip on your expenses is essential for any Canadian entrepreneur running a WooCommerce store. Fortunately, there are several effective strategies you can employ to minimize these fees and keep your margins healthy.

Let’s dive into some practical tactics that could save you money:

- Choose the Right Hosting: Opt for a reliable yet affordable hosting provider. Look for companies that specialize in WooCommerce hosting, as they often bundle features at a lower cost.

- Leverage Free Plugins & Themes: While premium add-ons can be enticing, there are many free plugins and themes available that offer essential features with little or no cost. Just be sure they are from reputable sources!

- Limit Add-Ons: Only invest in plugins that provide genuine value to your store. Evaluate whether the additional features they offer justify their costs.

- Negotiate Payment Processing Fees: When possible, negotiate with payment gateway providers to lower transaction fees. Every little bit counts in the long run!

- Optimize Your Site: A faster site can lead to higher conversion rates, meaning you might not need to spend as much on advertising to drive traffic.

By implementing these strategies, you can effectively manage and minimize the various fees and charges associated with operating a WooCommerce store in Canada. Being proactive about your costs not only keeps your finances healthy but also positions your business for long-term success.

Case Studies: Canadian Businesses and Their Experiences

In the realm of online shopping, understanding fees and charges is crucial for Canadian businesses utilizing WooCommerce. Here, we dive into real-life case studies of Canadian businesses that have navigated the complexities of fees, taxes, and charges while selling their products through WooCommerce.

1. Maple Leaf Goods: This eco-friendly Toronto-based company sells sustainable products, from reusable bags to organic cleaning supplies. Upon launching their WooCommerce store, they were surprised to discover the various fees associated with credit card processing. Although initially daunting, they learned to integrate a plugin that allowed them to clearly display all fees to customers at checkout. This transparency improved customer trust and satisfaction, leading to a 20% increase in sales within three months.

2. Northern Lights Décor: Operating out of Vancouver, this business specializes in handcrafted home décor items. They faced issues with provincial sales tax (PST) and the Goods and Services Tax (GST) when setting up their WooCommerce store. After consulting with an accountant specializing in e-commerce, they created a tax-inclusive pricing model, which made the pricing straightforward and hassle-free for customers. As a result, they noticed a significant decrease in cart abandonment rates.

3. Prairie Blooms: This small floral business turned to WooCommerce to expand their customer base beyond local deliveries. They quickly learned about the importance of shipping fees, especially for interprovincial deliveries. By researching their options and using a shipping plugin that calculated accurate rates in real-time, they saved costs and optimized their pricing strategy, leading to happier customers and improved profit margins.

These case studies underline the importance of understanding and managing the various fees and charges on WooCommerce. Through smart strategies and a willingness to adapt, these businesses turned challenges into opportunities for growth.

Conclusion: Maximizing Profitability with WooCommerce

In conclusion, navigating the landscape of WooCommerce fees and charges may feel overwhelming for Canadian businesses at first, but it’s essential for maximizing profitability. By taking a proactive approach to understanding these elements, you can not only protect your bottom line but also enhance customer experience.

1. Streamlining Fees: Familiarize yourself with the different types of fees you’ll encounter, such as transaction fees, payment gateway charges, and plugin costs. Keep track of these fees to evaluate how they impact your pricing strategy.

2. Clear Communication: Transparency is key when it comes to fees. Make sure customers are aware of shipping costs, taxes, and any additional charges upfront. This openness builds trust and can even discourage cart abandonment.

3. Tax Strategies: Stay on top of your tax obligations. Understanding the nuances of provincial sales tax (PST) and Goods and Services Tax (GST) can save your business from costly penalties and help structure your pricing effectively.

4. Invest in Technology: Leverage WooCommerce plugins that simplify financial tracking and automate calculations for shipping and taxes. Utilizing tools designed for Canadian businesses can save time and reduce errors in the long run.

By focusing on these strategies, Canadian WooCommerce merchants can transform their online stores into profit-generating machines. Remember, every challenge presents an opportunity; embrace these tools and resources to boost your business and profitability!