In the world of eCommerce, every little detail can make a significant difference, especially when it comes to payment processing. Many WooCommerce store owners might consider charging extra fees for credit card payments to offset processing costs. Not only can this approach help improve your bottom line, but it’s also essential for transparency with your customers. In this post, we’ll explore how you can implement extra credit card fees and why it might be a favorable option for your online store.

Understanding WooCommerce Payment Processing

WooCommerce is a robust plugin for WordPress that empowers anyone to create and manage an online store. At the heart of WooCommerce is the payment processing system, handling customer transactions securely and efficiently. Let’s break down how it works:

- Payment Gateways: WooCommerce supports various payment gateways like PayPal, Stripe, and Authorize.net, allowing customers to pay using credit cards, debit cards, or their preferred payment methods.

- Transaction Fees: Each payment gateway charges its own set of transaction fees, usually a percentage of the sale plus a fixed fee. For instance, Stripe might charge 2.9% + $0.30 per transaction.

- Security Measures: WooCommerce takes security seriously. It uses SSL certificates and follows Payment Card Industry Data Security Standards (PCI DSS) to ensure safe transactions.

- Checkout Experience: A smooth and user-friendly checkout process can help reduce cart abandonment. WooCommerce allows you to customize your checkout page to retain customers without compromising security.

As a store owner, it’s crucial to understand these elements to manage costs effectively and offer the best experience possible for your customers. By knowing how payment processing works, you can better strategize in aspects like adding extra fees for credit card payments.

Why Charge Extra Fees for Credit Card Payments?

Charging extra fees for credit card payments might feel a bit unusual at first, but there are several solid reasons why businesses consider this approach. Let’s explore a few key factors that justify the additional charges.

- Processing Costs: One of the most significant reasons businesses implement extra fees is the high transaction costs associated with credit card payments. Payment processors typically charge around 2.9% plus a flat fee (often around $0.30) per transaction. For small businesses or those with tight margins, these fees can add up quickly. By passing on this cost to customers who prefer credit card payments, businesses can maintain their profitability.

- Transaction Disputes: Credit card payments often come with a greater risk of chargebacks and disputes. If a customer disputes a charge, businesses may incur additional fees or face penalties. Extra charges for credit card payments can help mitigate the potential financial loss from these disputes.

- Encouraging Alternative Payment Methods: By charging extra for credit card payments, businesses create an incentive for customers to choose alternative, often less costly payment methods. Options like bank transfers or debit card transactions usually incur lower fees, which can benefit both the business and the consumers.

- Transparency: When businesses clearly communicate the extra fees for credit card payments, it fosters transparency. Customers appreciate knowing where their money is going, and this honesty can lead to greater customer trust and loyalty.

In a nutshell, while some consumers might be initially resistant to these extra charges, many businesses find that a well-communicated and justified fee structure helps cover their costs while still providing excellent service.

Setting Up Extra Fees in WooCommerce

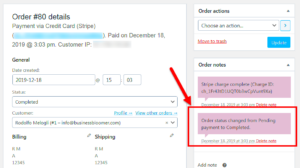

If you’ve decided to implement extra fees for credit card payments in your WooCommerce store, you’ll be pleased to know that the process is fairly straightforward. Here’s a step-by-step guide to help you along the way!

- Choose the Right Plugin: WooCommerce doesn’t come with built-in features for adding extra fees, so you’ll need to choose a third-party plugin that allows you to do so. Some popular options include:

- WooCommerce Extra Fees Plugin: This plugin offers a ton of flexibility and lets you easily configure fees based on various conditions.

- WooCommerce Payment Gateway Charges: Allows you to specify fees for different payment gateways, including credit cards.

| Type of Fee | Description |

|---|---|

| Flat Fee | A fixed amount added for credit card payments. |

| Percentage Fee | A percentage of the total transaction amount. |

| Conditional Fee | Fees that apply based on total cart value or specific products. |

By following these steps, you’ll not only help your business cover costs associated with credit card transactions but also maintain a positive customer experience. Happy selling!

5. Different Methods to Implement Extra Fees

When it comes to charging extra fees for credit card payments in WooCommerce, you have several methods at your disposal. Each method offers unique functionalities, benefits, and potential drawbacks. Let’s explore these options below:

- Custom Code Snippets: If you have coding skills or a developer on hand, you can add custom code to your theme’s functions.php file. This method gives you stringent control over how and when fees are applied. However, it may require frequent updates and careful management to avoid compatibility issues.

- WooCommerce Settings: By default, WooCommerce doesn’t allow extra fees based on payment methods. However, you can leverage settings within WooCommerce to accomplish this by offering discounts for alternative payment methods, effectively encouraging customers away from credit card payments.

- Discounts on Checkout: Another indirect way to charge extra for credit cards is to provide discounts for other payment methods during checkout. While this isn’t a direct approach to imposing fees, it encourages customers to rethink their payment choices.

- Manual Fee Management: You can also choose to inform customers up front about an additional charge for credit card payments. This may be more acceptable in certain industries. Just ensure that the fee is clearly stated on the product pages and during checkout.

Consider the overall user experience when implementing these fees; transparency is key to maintaining good customer relationships!

6. Using Plugins to Manage Extra Fees

The convenience and flexibility of plugins make them a popular choice for managing extra credit card fees in WooCommerce. With a variety of plugins available, you can ensure that your charging structure aligns with your business needs. Let’s dive into the benefits and popular options:

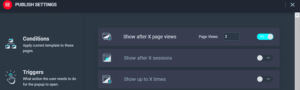

- Ease of Use: Most plugins are designed with user-friendliness in mind. You can typically set up and configure them without any coding knowledge, simplifying the process significantly.

- Flexibility: Many plugins allow you to set dynamic fees based on various conditions such as order total, payment method, or even customer role. This flexibility means you can create a tailored fee structure.

- Automation: Plugins manage fees automatically during checkout, saving you time and reducing errors. This automation also enhances the overall customer experience by preventing last-minute surprises.

Here’s a quick table listing some popular plugins:

| Plugin Name | Features | Price |

|---|---|---|

| WooCommerce Extra Fees Plugin | Custom fee structures, conditions-based fees | $39 |

| WooCommerce Conditional Shipping and Payments | Conditionally manage payments and fees | $79 |

| WooCommerce Fees and Discounts | Dynamic fees based on cart rules and products | $49 |

In summary, using plugins to manage extra fees for credit card payments in WooCommerce is an advantageous strategy that combines ease of use, flexibility, and automation, ensuring smooth transactions for both you and your customers!

7. Custom Coding for Advanced Fee Structures

When it comes to handling credit card payments in WooCommerce, businesses often seek flexibility in their fee structures. While many plugins offer standard options, custom coding can take your extra fee structures to the next level. Custom coding allows you to implement complex conditions and rules tailored to your unique business model. For instance, you might want to charge extra fees based on the order total, buyer location, or even specific payment gateways used.

Here are some scenarios where custom coding can be particularly beneficial:

- Tiered Fees: Charge different rates based on the order size. For example, a flat fee for small orders and a percentage for larger ones.

- Conditional Fees: Implement fees that apply only under certain circumstances, such as shipping method or time of purchase.

- Currency-Based Fees: Adjust fees based on customer geography, currency, or specific market conditions.

To get started with custom coding, it’s advisable to have a solid understanding of PHP and WooCommerce’s action hooks and filters. If coding isn’t your strength, collaborating with a developer can save you time and headaches. They can create a custom plugin that seamlessly integrates with your existing setup, ensuring that your fee structures are not only functional but also user-friendly.

With custom coding, you can craft an extra fee system that enhances your revenue while maintaining customer satisfaction. Just remember to keep the coding well-documented for future updates and consider how your changes might affect overall site performance.

8. Legal Considerations and Transparency

Implementing extra fees for credit card payments in WooCommerce isn’t just about optimizing revenue; it’s also crucial to navigate the legal landscape properly. Many countries mandate transparency when it comes to additional charges, ensuring customers are aware of all costs upfront. This transparency builds trust and can significantly affect customer satisfaction and loyalty.

Here are some essential legal considerations to keep in mind:

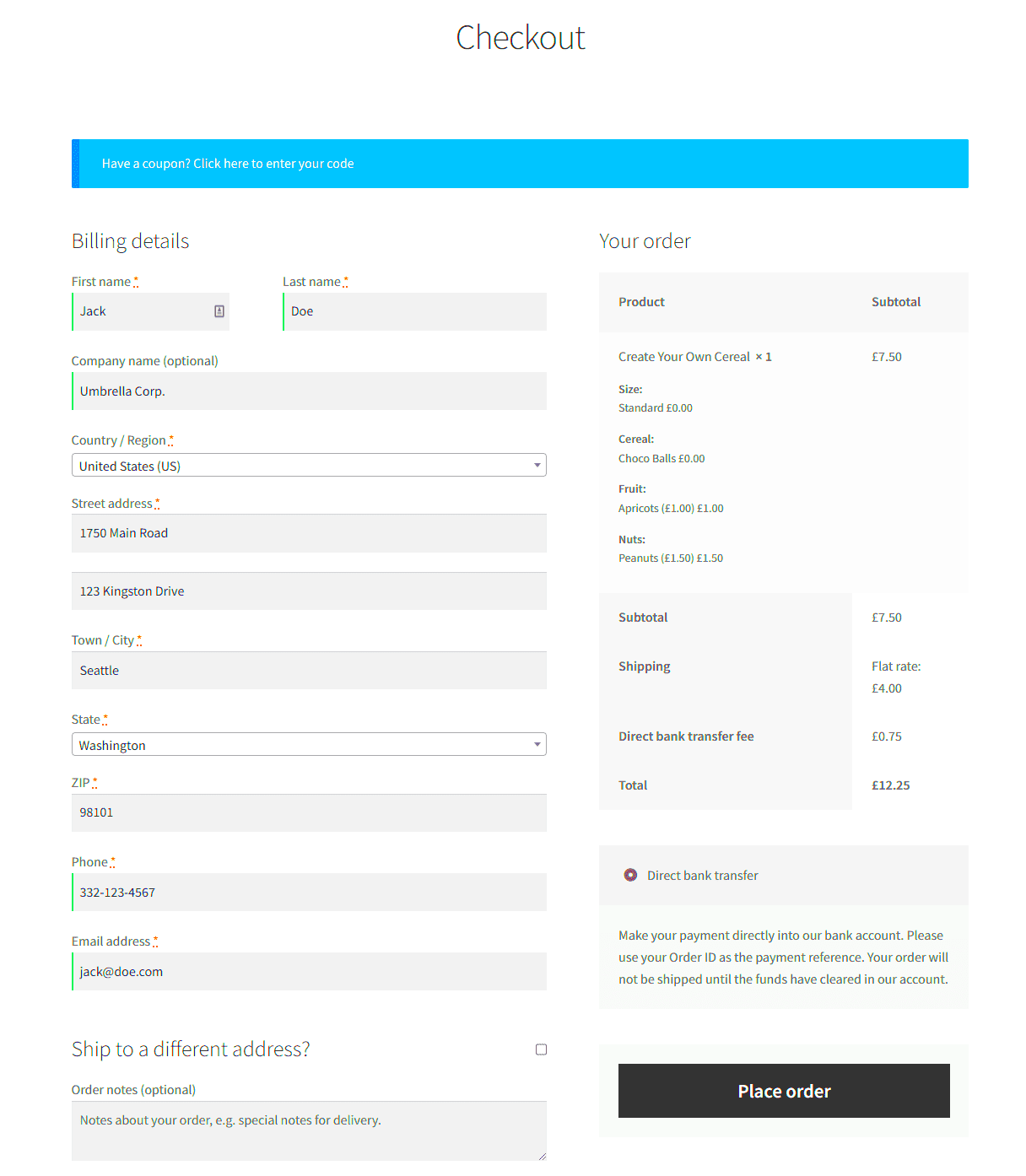

- Disclosing Fees: Clearly display any additional fees associated with credit card payments before the customer reaches the checkout. This helps prevent surprises and minimizes cart abandonment.

- Compliance with Regulations: Familiarize yourself with laws regarding payment processing in your respective country or region. Some regulations specify a maximum permissible surcharge for credit card payments.

- Consumer Rights: Respect local consumer rights laws, which may dictate how additional fees are presented to customers and the need for refunds.

To ensure compliance, you may want to consider including an FAQ section on your site explaining your fee structure. Moreover, adding a breakdown of fees during the checkout process can help customers understand what they are paying for. This not only fortifies transparency but also aids in building a positive brand reputation.

Remember, while charging extra fees can be legitimate, the way you communicate these fees to customers will make all the difference in maintaining a healthy relationship with your clientele.

Best Practices for Communicating Fees to Customers

When it comes to managing customer expectations regarding extra fees for credit card payments in WooCommerce, communication is key. Customers tend to appreciate transparency, so it’s important to convey information clearly and effectively. Here are some best practices to keep in mind:

- Display Fees Upfront: Make sure to add any additional fees early in the checkout process. This could be through a simple line of text or a small banner that indicates the credit card processing fee.

- Use Clear Language: Avoid jargon and complicated terms. Instead of saying, “processing fee,” say “additional charge for using a credit card.” Clarity can prevent confusion.

- Justify the Fees: If possible, explain why these fees exist. Perhaps they cover transaction costs or allow your business to provide higher-quality products. When customers understand the reasoning, they may be more accepting.

- Utilize Notifications: Consider adding pop-up notifications or tooltips next to the credit card option. This alerts customers that choosing this payment method includes an additional fee.

- Highlight Total Cost: Always show the total cost at the final step of the checkout process, including the fee. This reassures customers that they won’t encounter hidden charges.

- Seek Customer Feedback: After implementing your fee structure, gather feedback from customers. Surveys or follow-up emails can provide insights into how your fee communication can be improved.

Incorporating these practices not only enhances transparency but also builds trust with your customers, making them more likely to complete their purchase, even with added fees.

Conclusion: Balancing Fees and Customer Experience

In the world of eCommerce, especially with platforms like WooCommerce, balancing fees with a positive customer experience is essential. Nobody likes unexpected costs, yet, maintaining the operational efficiency of your online store often requires additional charges, especially for payment processing. So, how do you strike the right balance?

First off, it’s all about transparency and communication. As discussed earlier, customers value upfront information about fees. If they know what to expect, dissatisfaction and cart abandonment rates can decrease dramatically.

Next, consider alternative payment options. Offering a variety of payment methods can reduce reliance on credit cards, allowing you to minimize or even eliminate those extra fees. For example, options like PayPal or direct bank transfers might come with lower costs for both you and the customer. You can also explore engaging rewards programs that incentivize customers to prefer payment methods that don’t incur fees.

Additionally, think about bundling costs. Instead of charging a separate fee for credit card payments, consider incorporating these costs into the product price. Customers may be more willing to absorb the cost if they perceive it as part of the overall product value.

In conclusion, while implementing extra fees for credit card payments may be necessary, doing so in a way that respects customer experience can lead to higher satisfaction and loyalty. Maintain open lines of communication and remain flexible to find the best strategy for your business and your customers alike.