When you run an online store using WooCommerce, one aspect that often catches store owners off guard is payment processing fees. These fees can chip away at your profits and vary significantly depending on the payment gateways you choose. Fear not! Understanding these fees and knowing how to manage them effectively can make a significant difference in your bottom line.

Understanding Payment Processing Fees in WooCommerce

Payment processing fees are charges that payment processors impose for handling transactions made on behalf of your online store. In WooCommerce, these fees can fluctuate based on multiple factors, including the payment gateway, transaction volume, and the country in which your business operates. Let’s break this down a bit further:

- Types of Fees

- Transaction Fees: These are fees charged per transaction, typically a percentage of the sale plus a fixed amount. For example, a processor might charge 2.9% + $0.30 per sale.

- Monthly Fees: Some payment gateways have a monthly subscription fee that you need to consider, regardless of whether you make sales.

- Chargeback Fees: If a customer disputes a transaction and initiates a chargeback, you may incur additional fees.

- Factors Influencing Fees:

- Payment Gateway: Each gateway has its unique fee structure. It’s crucial to compare various options.

- Transaction Volume: High-volume businesses may qualify for lower rates.

- Business Location: Fees can vary by country or region, impacting your costs.

By identifying and understanding these different fees, you can make informed decisions that minimize costs and maximize your earnings, making your WooCommerce experience much more rewarding.

Types of Payment Processing Fees

When you’re running an online store using WooCommerce, understanding the various types of payment processing fees is key to managing your finances effectively. These fees can cut into your profits if you’re not careful, so let’s break down the main types you might encounter:

- Transaction Fees: These are the fees charged for processing each transaction. They can vary based on the payment gateway you choose. Typically, they’re a percentage of the sale plus a flat fee.

- Merchant Account Fees: If you’re using a dedicated merchant account, you might face additional monthly fees. These can include setup fees, monthly maintenance fees, and even termination fees if you decide to switch providers.

- Chargeback Fees: If a customer disputes a charge and requests a chargeback, you might incur additional fees, sometimes significant ones. It’s essential to handle complaints and customer service effectively to minimize chargebacks.

- Currency Conversion Fees: If you’re selling internationally, watch out for costs associated with currency conversion. Payment gateways usually charge a percentage on top of the standard transaction fees to cover these costs.

- Refund Fees: Some payment processors charge fees for processing refunds. It can be frustrating as it feels like you’re paying for returning the money to your customer.

By familiarizing yourself with these fee types, you’ll be better equipped to make informed decisions about your payment processing strategy!

Strategies to Mitigate Payment Processing Fees

Now that you understand the different types of payment processing fees in WooCommerce, let’s explore some effective strategies to keep those costs down. After all, every penny saved can contribute significantly to your bottom line!

- Shop Around for Payment Processors: Not all payment processors are created equal. Take the time to compare rates. Look at both percentage fees and flat fees; sometimes, a slightly higher percentage may be better overall.

- Negotiate Fees: If you have a solid sales volume, don’t hesitate to negotiate your fees with your payment processor. Often, they’re willing to offer discounts to retain loyal merchants.

- Implement Minimum Purchase Requirements: By setting a minimum amount for transactions, you can offset fees associated with small sales, thus ensuring that each transaction is worth the processing fee.

- Encourage Credit/Debit Card Payments: Some payment methods carry higher fees than others. Encourage customers to use credit or debit cards if they come with lower processing fees.

- Optimize Your Checkout Process: A streamlined checkout can help reduce the chances of cancellations and chargebacks. Ensure your process is user-friendly to avoid unnecessary fees.

Remember, it’s about finding that sweet spot between convenience for your customers and cost-effectiveness for your business. By implementing these strategies, you can significantly reduce your payment processing expenses!

Implementing Fee Adjustments in WooCommerce

When it comes to handling payment processing fees in WooCommerce, implementing fee adjustments can be a game-changer for your online store. This feature allows you to pass some or all of these fees onto your customers, helping you maintain your profit margins. But how do you actually set this up? Let’s walk you through it!

First, you’ll need to add a plugin that manages fees in WooCommerce. Here are a few popular options:

- WooCommerce Payment Fees: This plugin allows for simple fee adjustments based on the chosen payment method.

- WooCommerce Extra Fees Plugin: Offers the flexibility of adding fees based on various conditions, such as cart subtotal or customer location.

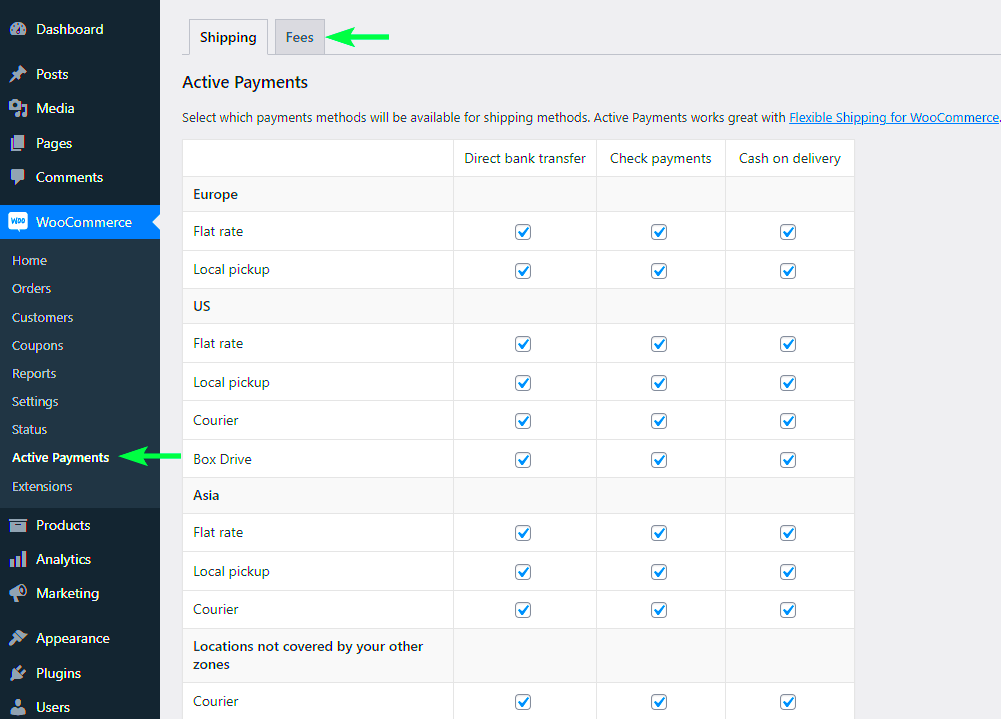

- WooCommerce Conditional Shipping and Payments: This one is particularly useful for creating conditional logic around fee adjustments.

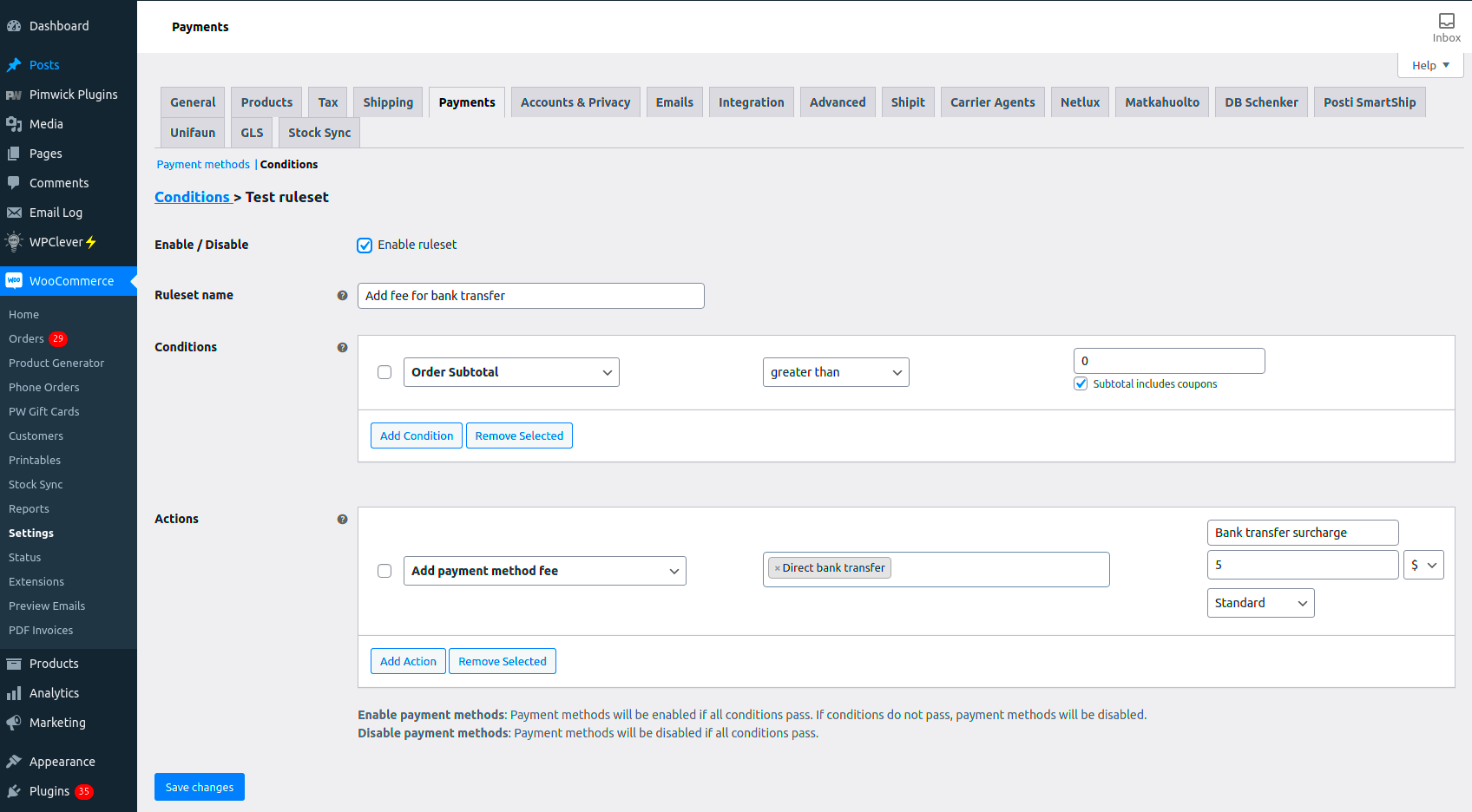

Once you’ve chosen your plugin and installed it, you can follow these steps:

- Navigate to the plugin settings in your WooCommerce dashboard.

- Specify which payment methods will incur a fee and set the percentage or fixed rate.

- Choose whether the fee will be displayed to the customer during checkout.

- Test the adjustments to ensure they’re functioning correctly.

Remember, while passing on fees may help you save costs, transparency is key. Don’t forget to clearly communicate any additional fees during the checkout process to maintain customer trust.

Communicating Fees to Customers Effectively

Clear communication is crucial when it comes to handling additional payment processing fees in WooCommerce. If customers see unexpected charges at checkout, it can lead to cart abandonment and a negative shopping experience. So, how can you effectively communicate these fees? Let’s dive into some best practices!

First off, be upfront about any fees right from the start. Consider adding a small note on your product pages or in the shopping cart that indicates that payment processing fees may apply. This preemptive notice can soften the blow later on.

You might also incorporate these fees into your pricing strategy:

- Inclusive Pricing: This means bundling the fee into the product price, so customers don’t see it as a separate charge.

- Clear Checkout Summary: Make sure the checkout page highlights any additional fees. A simple breakdown table works wonders:

| Item | Price |

|---|---|

| Product A | $30.00 |

| Payment Processing Fee | $2.50 |

| Total | $32.50 |

Additionally, don’t hesitate to leverage different communication channels. Use social media, newsletters, or even on-site pop-ups to inform customers of any fees before they finalize their purchase. This way, they will feel more prepared and less blindsided at checkout.

In summary, being upfront about fees, including them in the pricing strategy, and utilizing various communication channels can greatly enhance your customers’ experience while protecting your bottom line.

Using Plugins to Manage Payment Processing Fees

Managing payment processing fees in WooCommerce can feel overwhelming, but the good news is that there are many plugins designed specifically to make your life easier. These plugins can help you track fees, customize charge structures, and even display costs clearly to your customers at checkout. Here are some essential

- WooCommerce Fee Manager: This plugin allows you to easily add fees based on payment methods. You can set fixed or percentage-based fees and even apply conditions based on cart totals.

- WP Simple Pay: If you’re using Stripe for payments, this plugin allows you to add processing fees directly to your checkout and provides a smooth user experience.

- Payment Gateway Based Fees and Discounts: This versatile plugin lets you set fees and discounts based on different payment gateways. You can incentivize customers to use cheaper payment options by adding a discount on the other end!

- WooCommerce Custom Fees: Offering flexibility, this plugin allows you to create custom fees, which can easily be edited through the admin panel.

Using plugins can save time and money by automating fee management and offering tailored options. When selecting a plugin, consider your specific needs and payment gateways. Always test the plugin before going live to ensure it works seamlessly and enhances your checkout process.

Best Practices for Reducing Transaction Costs

Reducing transaction costs is essential for improving your bottom line and enhancing customer satisfaction. While fees are often unavoidable, there are several best practices you can adopt to minimize these costs:

- Compare Payment Processors: Not all payment processors charge the same fees. Take the time to compare gateway fees, transaction fees, and monthly service fees. Sometimes switching providers can save you a considerable amount.

- Negotiate Rates: If your business is processing a significant volume of transactions, don’t hesitate to negotiate with your payment processor for lower rates. Most companies are willing to discuss terms for valued clients.

- Optimize Checkout Process: Simplifying your checkout process can lead to faster transactions, reducing the likelihood of abandoned carts and ultimately leading to more completed sales.

- Encourage Direct Bank Transfers: For larger transactions, encourage customers to use direct bank transfers. These usually carry lower fees than credit card charges.

- Implement Minimum Purchase Amounts: Setting a minimum order amount for certain payment methods can ensure that you only incur transaction fees on larger orders.

By implementing these practices, you can significantly reduce your overall transaction costs while maintaining a positive user experience. Staying proactive about managing fees will ultimately support your financial health and growth.

How to Handle Payment Processing Fees in WooCommerce

Running an online store using WooCommerce often entails dealing with payment processing fees, which can cut into your profits if not managed effectively. Understanding how these fees work and finding ways to minimize their impact is vital for maintaining a healthy bottom line. This guide will help you identify strategies for handling payment processing fees in your WooCommerce store.

Here are a few tips to manage your payment processing fees:

- Choose the Right Payment Gateway: Select a payment gateway that offers competitive fees. Compare various options and consider their transaction fees, monthly charges, and other costs.

- Negotiate Fees: If your business has a substantial volume of sales, don’t hesitate to negotiate your fees with payment processors.

- Increase Product Prices: Adjusting product prices slightly to account for processing fees can help maintain your profit margins.

- Optimize Checkout Process: A smoother checkout process may lead to fewer abandoned carts, ultimately reducing overall transaction fees.

- Use Multiple Payment Options: Offering various payment methods can appeal to customers and potentially allow for reduced fees with certain options.

Additionally, consider implementing a Fee Table for transparency in your WooCommerce store. This table can help customers understand the additional fees associated with different payment methods, reinforcing trust while managing your processing costs.

By analyzing your current fees, exploring alternative options, and implementing these strategies, you can significantly reduce the burden of payment processing fees in your WooCommerce store, ultimately maximizing profitability.

Conclusion

Optimizing your WooCommerce payment processing involves choosing cost-effective gateways, negotiating fees, and strategically adjusting pricing, all of which contribute to a more profitable online business.