Keeping an eye on the vector stock market can seem daunting at first, but there are plenty of tools and resources available to simplify the process. Here are some you might find particularly helpful:

- Stock Screening Apps: Platforms like Finviz and Yahoo Finance offer powerful screening tools that let you filter stocks by various metrics, including performance, volume, and technical indicators.

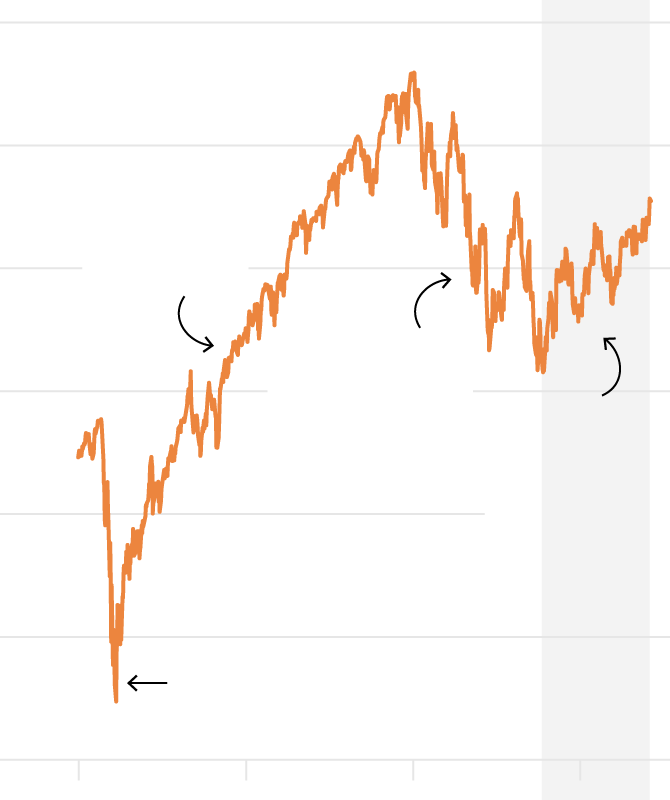

- Charting Software: Tools like TradingView or MetaTrader allow you to create custom charts and analyze stock trends visually. You can set up alerts for specific price levels or trends that you want to monitor.

- Social Media and Forums: Engaging with communities on platforms like Twitter and Reddit can provide valuable insights. Following experts and participating in discussions may help you learn about emerging trends or stocks worth monitoring.

- Market News Aggregators: Websites like Seeking Alpha and Bloomberg compile the latest news and articles on the vector stock market. Staying updated with current events can give context to stock movements.

- Investment Research Reports: Many brokerage firms offer in-depth research and analysis on various stocks. Subscribing to these reports can give you a more comprehensive view of market trends.

Leveraging these tools can help you make informed decisions and stay ahead of the curve in the dynamic world of vector stocks. The key is to find a combination that works for you and fits your investment style.

Key Indicators to Watch in Vector Stock Markets

Understanding what to monitor is vital when tracking vector stock market trends. Here are some essential indicators that can help you gauge market conditions effectively:

| Indicator | Description |

|---|---|

| Price Trends | Look for upward or downward price trends over various time frames. Understanding these can indicate overall market direction. |

| Volume Changes | Monitor trading volume as it signifies the strength of price movements. High volume accompanying price changes often signals a strong trend. |

| Technical Indicators | Tools like Moving Averages (MA) and Relative Strength Index (RSI) can help identify momentum and potential reversals in price movements. |

| Market Sentiment | Gauge the overall sentiment using news headlines, social media, and market analysis. Sentiment can heavily influence short-term trends. |

| Earnings Reports | Company performance metrics, especially earnings announcements, can significantly impact stock prices. Pay attention to these when tracking specific vectors. |

By keeping an eye on these key indicators, you’ll be better equipped to analyze vector stock trends and make well-informed investment decisions. Remember, the stock market is ever-changing, so staying adaptable and engaged is essential!

Analyzing Technical vs Fundamental Trends

When it comes to monitoring stock market trends, especially for vectors, understanding the difference between technical and fundamental analysis is crucial. Both methods offer valuable insights, but they approach the market from different angles.

Technical analysis focuses on historical price movements and volume of stocks. Traders use charts and technical indicators to identify patterns and trends. The underlying belief is that all available information is already reflected in the stock price, so studying the price action offers the best indication of future performance.

- Charts and Patterns: Trend lines, support and resistance levels, and moving averages are key components.

- Indicators: Tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) help in predicting potential price movements.

- Volume Analysis: Tracking trading volumes can indicate the strength of a price move or trend.

On the other hand, fundamental analysis looks at the economic factors that could affect a company’s stock performance. This includes earnings reports, industry performance, and broader economic indicators.

- Earnings Reports: Quarterly earnings and financial ratios can show the operating performance of a company.

- Market and Economic Indicators: Inflation rates, GDP growth, and unemployment figures can influence market behavior.

- News and Events: Keep an eye on how news affects stock prices, like shifts in consumer demand or regulatory changes.

In summary, while technical analysis is about timing your trades, fundamental analysis helps you understand what to invest in long-term. Combining both approaches can provide a well-rounded strategy, enhancing your effectiveness in navigating the stock market.

Common Mistakes to Avoid When Monitoring Trends

Monitoring stock market trends can be a daunting task, especially with so much information available. However, there are common pitfalls that both novice and experienced investors should be aware of to improve their trend-monitoring strategies.

- Ignoring Market Sentiment: Often, emotions can drive the market. Ignoring the overall sentiment can lead to poor investment decisions. Always evaluate the news and social media chatter.

- Over-reliance on Indicators: While indicators are useful, they are not foolproof. Relying solely on one or two indicators can be risky. Always use a combination of sources and analysis types.

- Neglecting to Set Stop-Loss Orders: Protecting your investments is crucial. Failing to set stop-loss orders can lead to significant losses when a trend suddenly reverses.

- Chasing Trends: It’s tempting to jump into a stock that’s rapidly rising, but this can lead to buying at a peak. Assess trends before making a decision.

- Failing to Adapt: The market is always evolving. Sticking rigidly to one analysis method or strategy without adapting to new information can hinder your results.

By being mindful of these common mistakes, you can enhance your trend-monitoring capabilities and make more informed decisions in the dynamic world of stock trading. Stay smart, stay aware, and always keep learning!

How to Create a Trend Monitoring Strategy

Creating a trend monitoring strategy for the vector stock market can seem daunting, but with a structured approach, it can be quite manageable. Here are some essential steps to kickstart your strategy:

- Define Your Goals: Start by asking yourself what you want to achieve. Are you looking for short-term gains or long-term investments? Clearly defined goals will guide your strategy.

- Choose Your Indicators: Select reliable indicators that help you track trends. Common indicators include:

- Moving Averages

- Relative Strength Index (RSI)

- Momentum Indicators

- Bollinger Bands

- Set Up a Monitoring System: Use software or platforms that allow you to visualize and analyze stock data. Many traders rely on charting tools that can help identify potential trends visually.

- Regular Reviews: Schedule weekly or monthly reviews of your strategy and make necessary adjustments. Keeping an eye on external factors like economic news or changes in market conditions can provide valuable insights.

- Backtesting: Before fully committing to your strategy, backtest it using historical data. This will help you understand its potential success and make informed adjustments.

Remember, the key to an effective trend monitoring strategy is to remain flexible. The stock market is fluid, and your strategy should adapt to new information and trends as they emerge. With practice, monitoring trends can become a powerful tool in your investment arsenal!

Case Studies of Successful Vector Trend Analysis

Examining real-world examples of successful vector trend analysis can provide valuable insights into effective strategies. Here are a couple of case studies worth noting:

Case Study 1: Tech Sector Resurgence

In early 2021, many investors noted a significant shift in tech stocks as remote work and online services gained traction. A group of analysts used moving averages combined with volume analysis to identify upward trends in several tech stocks like Zoom and Shopify. Here’s how they succeeded:

- Data Analysis: Analysts observed that stock prices consistently crossed above their 50-day moving averages.

- Volume Confirmation: Increased trading volumes supported the price movements, confirming the trend’s strength.

- Market Sentiment: They considered market sentiment powered by the pandemic, which helped solidify their bullish stance.

Case Study 2: Retail Sector Recovery

During the same year, certain retail stocks began showing signs of recovery as the economy reopened. A successful investor implemented a trend-following approach using the RSI and identified:

- Oversold Conditions: Retail stocks like Target and Walmart exhibited oversold RSI levels, indicating potential upward momentum.

- Sector Rotation: Monitoring sector performance helped him pivot investments from tech to retail at a critical stage.

These case studies underscore the importance of a well-researched approach to trend monitoring. With the right tools and strategies, successful investments in the vector stock market are certainly within reach!

Future Predictions for Vector Stock Markets

As we look to the future of vector stock markets, understanding trends is essential for both seasoned investors and newcomers. Several factors can influence future predictions, including economic indicators, advancements in technology, and changing consumer behaviors.

Current Trends: Observing patterns in the vector market reveals several key trends that could shape the future:

- Increased Automation: With the rise of AI and machine learning, vector stock trading is becoming more automated. This could mean quicker reactions to market changes and potentially higher profits for those who leverage these technologies.

- Environmental, Social, and Governance (ESG) Investing: More investors are prioritizing ESG factors. Companies that embrace sustainability and ethical practices are likely to attract greater investment, which could shift vector stock trends.

- Geopolitical Influences: Trade agreements, tariffs, and political stability can dramatically affect vector stocks. Keeping an eye on international relations and local policies is crucial for accurate trend predictions.

Analytical Tools: Utilizing advanced analytical tools can enhance our ability to predict trends in vector stocks. Software that incorporates big data analysis, sentiment analysis from social media, and global economic indicators can provide insights that were once difficult to obtain. Additionally, engaging with predictive analytics platforms can help investors make informed decisions based on probability rather than assumptions.

While it’s impossible to predict the future with certainty, being aware of these trends and utilizing the right tools can prepare investors to navigate the complexities of the vector stock markets ahead.

Conclusion and Final Thoughts on Trend Monitoring

In conclusion, effectively monitoring vector stock market trends is both an art and a science. It requires a blend of analytical skills, intuition, and an understanding of market behavior. By employing a variety of strategies, you can position yourself for success.

Key Takeaways:

- Stay informed: Regularly update your knowledge on market trends and economic indicators.

- Use technology: Invest in robust analytical tools that provide insights into market movements.

- Diversify your sources: Rely on a mix of data, including historical performance, analyst forecasts, and news reports.

Ultimately, maintaining a proactive approach to monitoring trends can lead to better investment decisions. Remember, the market is always evolving, and staying adaptable is crucial. Whether you’re analyzing vector stock performance or venturing into new territories, the key is to keep learning and adjusting your strategies as the landscape changes.

Happy investing!