Investing wisely requires a well-thought-out strategy, especially when it comes to stock selection. One innovative way to enhance your portfolio is through vector stocks, which are designed to maximize returns by tracking specific market trends. This guide will provide insights into what vector stocks are, their significance in investment, and how to effectively diversify your portfolio using them.

Understanding Vector Stocks and Their Importance

Vector stocks refer to securities that capture specific attributes of market trends and movements, allowing investors to align their holdings with targeted economic indicators. These stocks are essential for investors who seek to enhance their portfolio’s performance by focusing on sectors that are likely to experience growth. By investing in vector stocks, investors can better position themselves to leverage economic shifts and sectoral momentum. The significance of vector stocks lies in their ability to provide clearer insights into market dynamics. When investors understand the underlying vectors influencing stock performance—such as technological advancements or macroeconomic factors—they can make more informed decisions about their investment strategies. Moreover, vector stocks often exhibit correlated movements within sectors, making it easier for investors to gauge potential outcomes and strategically allocate funds across various areas of the market. This focus on industry-specific trends can ultimately lead to higher returns and reduced risk.

The Benefits of Diversifying Your Investment Portfolio

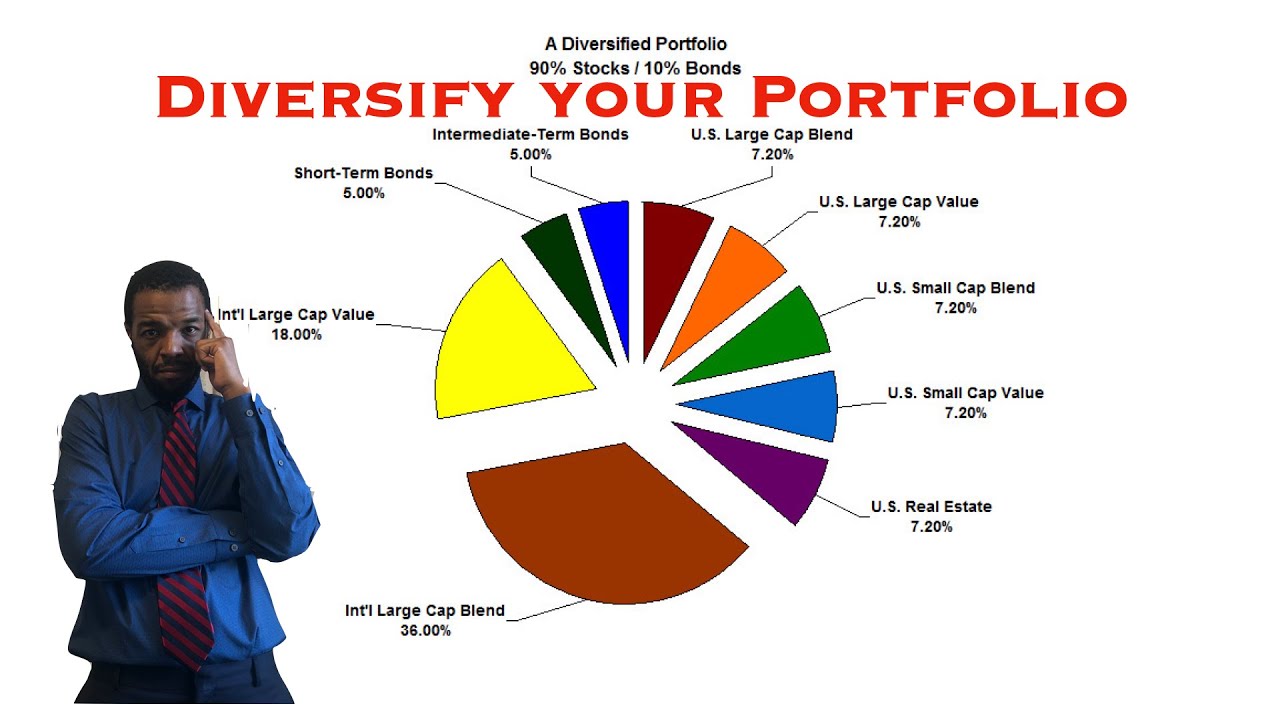

Diversification is a fundamental principle of investing, enabling risk mitigation and enhancing potential returns. By allocating investments across a range of asset types—including vector stocks—investors can shield their portfolios from volatility associated with any single investment. Here are some key benefits:

- Risk Reduction: Spreading investments helps reduce the impact of a poorly performing asset.

- Increased Return Potential: A well-diversified portfolio can tap into growth across various sectors.

- Market Stability: Holding a mix of asset types can provide more stable performance over time.

- Access to New Opportunities: Investing in vector stocks might open doors to emerging markets and sectors.

Identifying Potential Vector Stocks for Investment

When it comes to identifying potential Vector stocks for your investment portfolio, it’s essential to take a structured approach. Here are some strategies to guide you:

- Research Companies with Strong Fundamentals: Look for companies with robust financial health. Focus on key metrics such as revenue growth, profit margins, and debt-to-equity ratios. Tools like financial news websites or stock screeners can help streamline this process.

- Examine Market Trends: Vector stocks often align with emerging technologies or market trends. Consider sectors such as renewable energy, biotech, or artificial intelligence. Understanding market dynamics will help you spot growth opportunities.

- Consider Competitive Advantage: Invest in companies that boast a sustainable competitive edge. This might include unique products, patents, or a strong brand presence. Companies that can fend off competitors tend to provide stable returns.

- Analyze Historical Performance: While past performance isn’t always indicative of future results, examining historical stock performance can provide valuable insights. Look for stocks that have shown resilience during market downturns.

- Follow Analyst Ratings: Pay attention to analyst ratings and recommendations. However, don’t rely solely on them—conduct your own research to confirm findings. Sometimes, you might see value where others don’t.

By combining these strategies, you’ll be better equipped to identify vector stocks that hold the potential to elevate your portfolio. Remember, diligence in your research is key to making wise investment choices.

Strategies for Incorporating Vector Stocks into Your Portfolio

Once you’ve identified promising Vector stocks, it’s time to think about how to incorporate them into your investment strategy. Here are some effective strategies to consider:

- Diversification is Key: Ensure that your investment in vector stocks does not dominate your portfolio. Aim to diversify across different sectors. This helps manage risk while still capitalizing on potential high-growth areas.

- Weight Your Investments: Determine the proportion of your portfolio that you’d like to allocate to vector stocks. Depending on your risk tolerance, this might range from 5% to 20%. Keep adjusting based on performance and market conditions.

- Use Dollar-Cost Averaging: Instead of investing a lump sum all at once, consider spreading out your purchases. Invest a fixed amount at regular intervals, regardless of the stock’s price. This strategy can reduce the impact of volatility.

- Set Specific Goals: Have a clear understanding of what you intend to achieve with your Vector stock investments. Are you looking for short-term gains, or are you in for the long haul? This clarity will inform your buying and selling decisions.

- Regularly Review and Rebalance: Monitor your portfolio periodically. As the market changes, some stocks may outperform while others underperform. Regular rebalancing ensures that your investments align with your initial allocation strategy.

Incorporating Vector stocks into your portfolio can be a rewarding venture, provided that you do so thoughtfully. By implementing these strategies, you can maximize the potential benefits while safeguarding against market uncertainties.

Risk Management When Investing in Vector Stocks

When diving into the world of vector stocks, understanding and implementing effective risk management strategies is crucial. Vector stocks often belong to emerging industries, which can mean higher volatility. Here are some key approaches you can take to manage risks effectively:

- Diversification: Spread your investments across various sectors and companies. This reduces the impact of poor performance by any single stock.

- Set Stop-Loss Orders: By placing stop-loss orders, you can automatically sell a stock when it reaches a certain price, limiting potential losses.

- Regular Monitoring: Stay informed about market trends and the specific industry health. Regularly reviewing your portfolio can help you adjust to market changes.

- Risk Tolerance Assessment: Understand how much risk you can handle emotionally and financially. Tailor your investments to fit your own capacity for risk.

- Use of Financial Tools: Consider options like hedging to offset potential losses. Investment strategies like options trading can add a layer of protection.

Remember, while vector stocks can offer substantial returns, they also come with risks that need to be managed adeptly. Establishing a solid risk management plan can help you navigate the uncertainties and come out ahead.

Real-World Examples of Successful Vector Stock Diversification

Let’s look at a couple of real-world examples that illustrate how successful investors have diversified their portfolios with vector stocks. These success stories can provide insights and inspiration for your own investing journey. Example 1: Tesla, Inc. (TSLA) Tesla’s innovation in electric vehicles and energy solutions made it a popular vector stock. An investor who started with Tesla but diversified into:

- Battery technology firms

- Renewable energy suppliers

- Software companies focusing on autonomous driving

was able to balance out potential losses during market corrections, benefiting from the overall growth of the electric vehicle ecosystem. Example 2: The Tech Sector: A savvy investor recognized the rise of AI and machine learning. They diversified in the following way:

- Investing in semiconductor manufacturers

- Backing AI software development companies

- Including cybersecurity firms to address data protection as AI technologies expanded

This diversified approach not only mitigated risks associated with any one company’s performance but also capitalized on the holistic growth of related industries. By examining these examples, it’s clear that thoughtful diversification within vector stocks can lead to sustained success. Keeping an eye on interconnected sectors often yields opportunities that stand the test of market fluctuations.

Tools and Resources for Investing in Vector Stocks

Diving into the world of vector stocks can be a thrilling yet daunting task, especially if you’re looking to diversify your portfolio. Fortunately, there are plenty of tools and resources available to help you navigate this unique investment landscape. Here are some essentials:

- Stock Screeners: Websites like Finviz and Yahoo Finance offer powerful stock screening tools. You can filter stocks based on various criteria, such as price-to-earnings ratio, market cap, and recent performance, which is particularly useful when looking for vector stocks that match your investment goals.

- Financial News Websites: Keep up with the latest developments by following sites like Bloomberg, CNBC, and Seeking Alpha. They provide insights and analyses that are crucial for making informed decisions in vector stock investments.

- Investment Apps: Consider using apps like Robinhood, ETRADE, or Webull to buy and sell vector stocks. These platforms often have user-friendly interfaces and offer real-time data, making it easier to stay on top of your investments.

- Online Courses and Webinars: Many platforms like Coursera and Udemy offer courses specifically about stock market investing, including vector stocks. Webinars hosted by financial experts can also provide valuable insights.

- Communities and Forums: Joining forums like Reddit’s r/stocks or investing groups on Facebook can connect you with fellow investors. Sharing experiences and strategies can help you avoid pitfalls and discover new opportunities.

With these tools and resources at your disposal, you’ll be better equipped to research and invest wisely in vector stocks, allowing your portfolio to flourish.

Common Mistakes to Avoid When Investing in Vector Stocks

Investing in vector stocks can yield impressive returns, but it’s not without its pitfalls. Avoiding these common mistakes can save you time, money, and a lot of frustration:

- Neglecting Research: Failing to do your homework can lead to investments based on hype rather than solid data. Always research the fundamentals of the stocks you’re interested in.

- Overdiversification: While diversification is key, spreading your investments too thin can dilute your potential returns. Focus on a manageable number of stocks that you understand and believe in.

- Emotional Trading: Allowing emotions like fear and greed to dictate your investment decisions can lead to impulsive actions. Stick to your strategy and avoid reacting to market swings.

- Ignoring Fees: Transaction fees and taxes can eat into your profits. Be mindful of the costs associated with buying and selling vector stocks, especially if you’re trading frequently.

- Falling for FOMO: The ‘fear of missing out’ can lead to hasty decisions without proper analysis. Always evaluate whether a stock truly fits your portfolio before jumping in.

By steering clear of these mistakes, you’ll position yourself for a more successful investing journey in vector stocks. Happy investing!

How to Diversify Your Portfolio with Vector Stocks

Diversifying your investment portfolio is crucial for managing risk and maximizing potential returns. One of the innovative ways to achieve diversification is through vector stocks. Vector stocks represent companies that use vector science, involving advanced technology in fields such as biotechnology, pharmaceuticals, and artificial intelligence. Here’s how you can effectively diversify your portfolio using vector stocks:

Understanding Vector Stocks

Vector stocks offer a unique opportunity to tap into the burgeoning fields of technology and biotechnology. These stocks typically belong to companies that push the boundaries of science and engineering, making them a promising choice for investors.

Recommendations for Diversification

To effectively diversify with vector stocks, consider the following strategies:

- Research the Sector: Invest in companies across different sectors that utilize vector technologies, such as healthcare, energy, and software development.

- Consider Geographical Diversity: Look for vector stocks from companies based in various countries to mitigate geopolitical risks.

- Blend Growth and Stability: Combine high-risk growth vector stocks with more stable, established companies to balance your portfolio.

Key Considerations

Keep these factors in mind while investing:

| Factor | Description |

|---|---|

| Market Trends | Stay updated on the latest trends in technology and biotechnology. |

| Company Fundamentals | Analyze financial statements to assess a company’s profitability and growth potential. |

| Regulatory Environment | Be aware of regulations affecting vector science companies. |

In conclusion, diversifying your portfolio with vector stocks can enhance its resilience and growth potential. By researching the sector thoroughly, considering geographic diversity, and examining company fundamentals, you can build a well-rounded portfolio that aligns with your investment goals. As you embark on this journey, remain engaged and informed to make the most of your investment strategy.