Have you ever wondered how companies like Shutterstock make their money? Shutterstock has become a go-to platform for high-quality images, videos, and music, serving creators, marketers, and businesses worldwide. But behind the scenes, it’s a pretty interesting business model that combines technology, content licensing, and a global community of contributors. In this post, we’ll explore how

Overview of Shutterstock’s Revenue Streams

Shutterstock’s revenue mainly comes from several key sources, each contributing to its overall financial health:

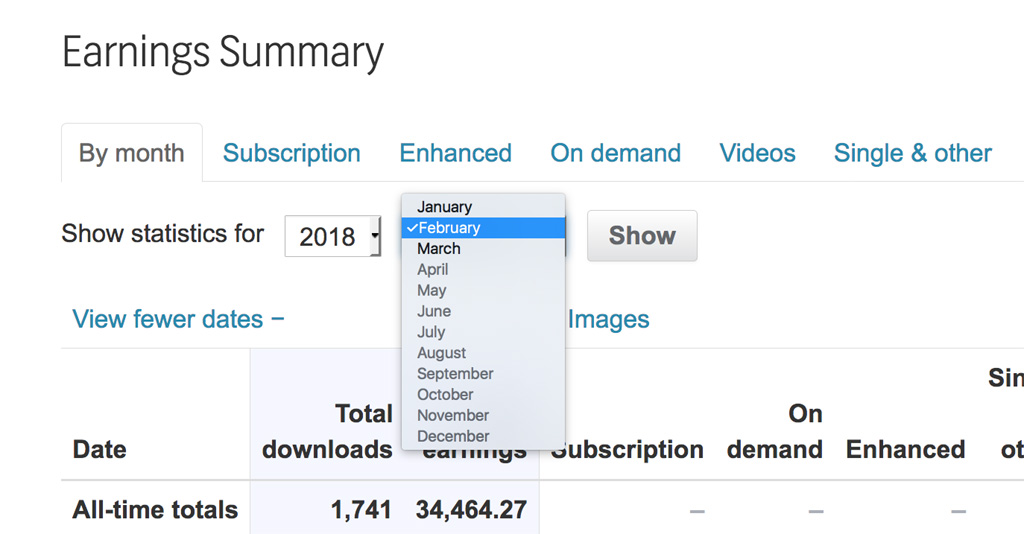

- Subscription Plans: The most popular way customers purchase images and videos. Users pay a monthly or annual fee for a set number of downloads, which provides a steady income stream for Shutterstock.

- On-Demand Downloads: For those who prefer not to commit to a subscription, Shutterstock offers pay-per-download options. This flexibility appeals to casual users or those with short-term needs.

- Contributors’ Royalties: Shutterstock compensates content creators through royalties when their media is downloaded. While this is an expense for Shutterstock, it also encourages a large and diverse library, which in turn drives more sales.

- Music and Footage Licensing: Besides images, Shutterstock earns from licensing stock music and video clips, catering to filmmakers, advertisers, and media outlets.

- Enterprise Solutions: Big businesses often need customized content packages or exclusive content, which Shutterstock provides through enterprise subscriptions and licensing agreements, often at premium prices.

These diverse revenue streams help Shutterstock maintain a robust financial profile, balancing recurring income with one-off sales and enterprise deals. As the digital content market continues to grow, Shutterstock’s ability to innovate and expand these streams is key to its ongoing success.

Historical Revenue Growth and Financial Performance

Over the years, Shutterstock has established itself as a major player in the stock media industry, and its financial journey is quite fascinating. Since its founding in 2003, the company has experienced steady growth, transforming from a small startup into a global powerhouse with millions of customers worldwide. If we look back, Shutterstock‘s revenue has shown a consistent upward trajectory, reflecting its expanding user base and diverse offerings.

For instance, in its early years, the company’s annual revenue was in the low millions, but as digital content consumption skyrocketed, so did its earnings. By 2015, Shutterstock began to report revenues exceeding $400 million annually, and this figure kept climbing. In fiscal year 2022, Shutterstock reported revenues around $850 million, marking a significant increase from previous years and showcasing strong financial health.

It’s also interesting to note how Shutterstock’s financial performance isn’t just about raw numbers. Their profitability, margins, and growth rates reveal a company that’s becoming more efficient and strategic in how it operates. Their gross profit margins typically hover around 40-50%, indicating healthy profitability. Additionally, their net income has seen fluctuations but generally trends upward as they optimize costs and expand their revenue streams.

Another key point is that Shutterstock’s quarterly earnings reports often beat analyst expectations, signaling a resilient business model. Despite challenges like market competition and shifting industry trends, the company’s ability to innovate and diversify has contributed to its strong financial performance. This consistent growth not only boosts investor confidence but also helps Shutterstock reinvest in new products and technology, fueling further expansion.

Factors Influencing Shutterstock’s Annual Earnings

Many factors come into play when determining Shutterstock’s annual revenue. Understanding these can give you a clearer picture of what drives their earnings and how they navigate the ever-changing digital landscape.

- Market Demand for Digital Content: As content creators, marketers, and businesses increasingly rely on high-quality visuals, Shutterstock benefits from rising demand. The more companies need images, videos, and music for their campaigns, the higher Shutterstock’s sales tend to be.

- Subscription and Licensing Models: Shutterstock primarily operates on a subscription basis, which provides predictable revenue streams. Their flexible plans cater to different types of users, from individual creatives to large enterprises, helping to stabilize income throughout the year.

- Product Diversification: Besides stock photos and videos, Shutterstock has expanded into music, editorial content, and AI-generated assets. This diversification attracts a broader customer base and opens up new revenue channels.

- Global Expansion: Moving into new markets and regions allows Shutterstock to tap into emerging demand for digital media. Their multilingual platforms and localized content help attract international clients, boosting overall earnings.

- Partnerships and Acquisitions: Collaborations with other tech companies and strategic acquisitions have played a role in Shutterstock’s growth. These moves often bring in new customers, enhance platform capabilities, and open up additional revenue opportunities.

- Technological Innovation: Investing in AI, machine learning, and user experience improvements helps Shutterstock stay ahead of competitors. Better search algorithms and content management tools increase customer satisfaction and retention, positively impacting earnings.

Of course, external factors like economic downturns, changes in digital advertising budgets, or shifts in consumer behavior can influence revenue fluctuations. But overall, Shutterstock’s ability to adapt and innovate remains central to maintaining and growing its annual earnings.

Comparison of Shutterstock’s Revenue with Competitors

When you look at Shutterstock’s financial performance, it’s interesting to see how it stacks up against other giants in the stock media industry. Companies like Adobe Stock, Getty Images, and iStock by Getty Images are some of Shutterstock’s main competitors, and each has its own way of capturing the market.

Shutterstock has built a reputation for its vast library of high-quality images, videos, and music, which has helped it generate substantial revenue year after year. As of recent reports, Shutterstock’s annual revenue hovers around a few billion dollars, making it one of the leaders in the stock content space.

Now, comparing that to Adobe Stock, which is part of Adobe’s Creative Cloud suite, we see a slightly different picture. Adobe Stock benefits from Adobe’s huge user base of creative professionals, and its integration with popular tools like Photoshop and Illustrator gives it a competitive edge. Adobe Stock’s revenue is also in the billions, but some analysts suggest that Adobe’s overall revenue from its Creative Cloud subscriptions far exceeds what Adobe Stock alone makes.

Getty Images, another major player, operates with a slightly different model—focusing more on exclusive, high-end images and licensing rights. Getty tends to cater to enterprise clients and offers premium content, which can command higher prices. While Getty’s revenue is comparable to Shutterstock’s, its business model emphasizes exclusivity over volume, which influences its revenue streams differently.

| Company | Estimated Annual Revenue | Market Focus |

|---|---|---|

| Shutterstock | ~$1.5 – $2 billion | Mass-market stock images, videos, music |

| Adobe Stock | Part of Adobe’s overall $15 billion revenue (Creative Cloud) | Creative professionals, integrated workflows |

| Getty Images | ~$1 billion | Premium, exclusive content for enterprise |

So, while Shutterstock may not be the largest player overall, it definitely holds a strong position in the mid-market segment, competing effectively with these industry giants. Their diverse offerings and user-friendly platform give them an edge in attracting a broad customer base.

Future Revenue Projections and Business Outlook

Looking ahead, the future of Shutterstock’s revenue depends on several factors, including market trends, technological innovations, and how well they adapt to changing customer needs. Experts generally see positive signs for Shutterstock’s growth prospects.

One of the biggest drivers of future revenue will be the ongoing shift toward digital content creation. As more businesses, marketers, and creators rely on stock media for their campaigns, demand is expected to increase. Shutterstock’s investment in expanding its content library and improving its platform features—like AI-powered search and personalized recommendations—positions it well to capture this growing market.

Additionally, Shutterstock has been exploring new revenue streams beyond traditional stock images. For instance, they’re expanding into areas like custom content creation, licensing for emerging media formats, and subscription-based models tailored for different user segments. These initiatives could boost revenue and diversify income sources.

However, competition remains fierce, and the company must continually innovate to stay ahead. The rise of free or low-cost content platforms and user-generated content means Shutterstock needs to offer unique value that users can’t find elsewhere.

Analysts project that Shutterstock’s revenue could grow at a compound annual growth rate (CAGR) of around 5-10% over the next five years, assuming successful execution of their strategic plans. This growth would be driven by increased adoption of digital marketing, e-learning, and content creation in various industries worldwide.

In summary, Shutterstock’s future looks promising, with steady growth on the horizon. Their focus on expanding content, leveraging new technologies, and maintaining a strong global presence will be key to sustaining and increasing their revenue in the years to come.

Conclusion and Key Takeaways on Shutterstock’s Financial Success

Shutterstock has established itself as a leading player in the digital media and stock photography industry, consistently demonstrating impressive financial growth over the years. Its diversified revenue streams, including subscriptions, image sales, and video content, contribute to a robust and resilient business model. The company’s strategic investments in technology and global expansion have further fueled its success, enabling it to adapt to shifting market demands and maintain a competitive edge.

Key takeaways from Shutterstock’s financial performance include:

- Consistent Revenue Growth: Shutterstock has shown steady year-over-year revenue increases, reflecting strong market demand and effective business strategies.

- Diversified Income Sources: The company’s revenue is generated from various channels such as subscription plans, on-demand image sales, and video content, reducing reliance on any single source.

- Global Presence: Operating in numerous countries allows Shutterstock to tap into diverse markets and expand its customer base.

- Innovation and Technology: Continuous investment in technology enhances user experience and broadens the company’s offerings, supporting sustained financial success.

In summary, Shutterstock’s ability to diversify revenue, expand globally, and innovate positions it well for continued financial growth. Its impressive annual revenue figures underscore its importance in the digital content industry and highlight its potential for future success.