Hey there! If you’ve ever browsed for stock photos, videos, or music online, chances are you’ve come across Shutterstock. It’s one of the biggest names in digital media licensing, offering a vast library of creative assets to businesses, marketers, designers, and content creators worldwide. With its user-friendly platform and extensive collection, Shutterstock has carved out a significant space in the stock media industry. Over the years, it’s evolved from just a photo marketplace to a comprehensive content solution provider. As we look ahead to 2025, many are curious about how

Factors Influencing Shutterstock’s Valuation in 2025

Several key factors are set to play a role in determining Shutterstock’s valuation in 2025. Let’s break down some of the most influential ones:

- Market Trends in Digital Content: The increasing demand for high-quality visual content driven by social media, digital marketing, and remote work means more businesses need stock images, videos, and music. If this trend continues, Shutterstock’s revenues could see a boost.

- Technological Advancements: Innovations like AI-driven content curation, search algorithms, and even AI-generated media are changing the game. Shutterstock’s ability to adopt and integrate these technologies could positively impact its valuation.

- Competitive Landscape: Companies like Adobe Stock, Getty Images, and emerging platforms are vying for market share. How Shutterstock differentiates itself—through pricing, licensing options, or exclusive content—will influence its growth prospects.

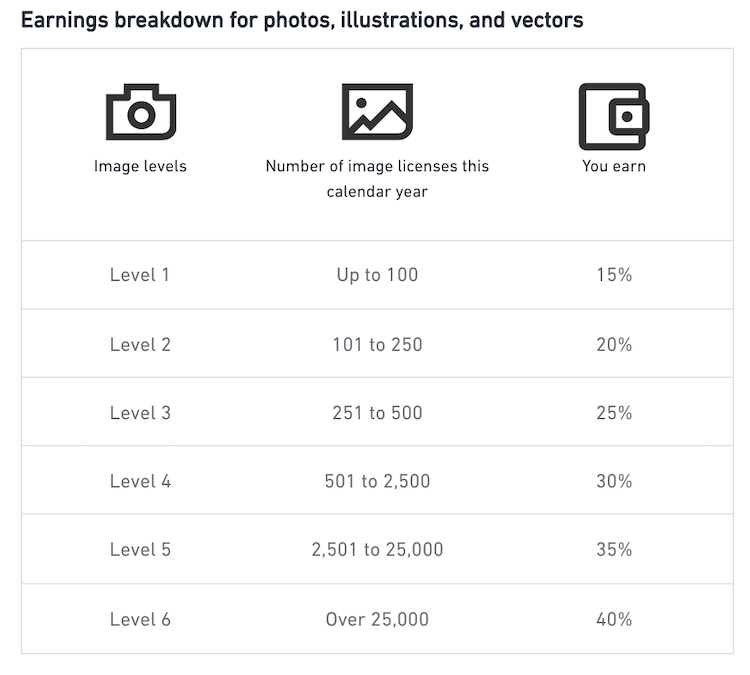

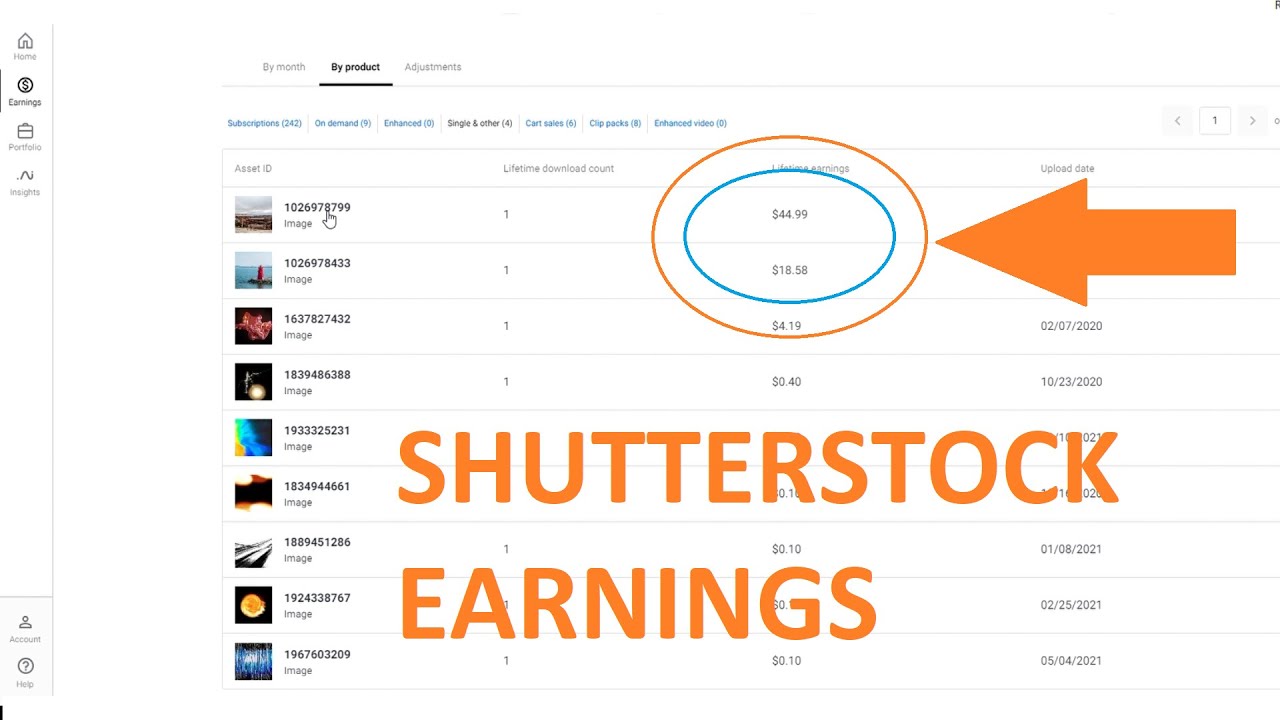

- Subscription and Revenue Models: The strength and diversification of revenue streams, such as subscription plans versus pay-per-download options, will affect financial stability and investor confidence.

- Global Expansion: Expanding into new markets and regions with growing demand for digital content can significantly impact revenue growth and valuation.

- Economic Factors and Market Sentiment: Broader economic conditions, such as global economic health, inflation rates, and investor sentiment toward tech and media companies, will also influence valuation levels.

In summary, Shutterstock‘s valuation in 2025 will be shaped by a mix of technological progress, market dynamics, competitive moves, and economic trends. Staying adaptable and innovative will be key for Shutterstock to maximize its value and maintain its position as a leader in the digital media space.

Recent Financial Performance and Revenue Trends

So, how has Shutterstock been doing lately? Let’s dive into its recent financial performance and see what the numbers tell us. Over the past few years, Shutterstock has shown resilience and adaptability, especially given the shifts in digital content consumption. In 2023, the company reported revenues of approximately $800 million, marking a steady growth compared to previous years. That’s a solid sign of ongoing demand for stock images, videos, and creative resources.

One thing to note is the company’s shift towards diversifying its revenue streams. While traditional image licensing remains a core part of the business, Shutterstock has been investing more in video content, music, and creative tools. This diversification has helped buffer against market fluctuations in any single segment.

Looking at quarterly performance, Shutterstock has experienced consistent growth in active subscribers, with a recent uptick in enterprise clients who are seeking custom content solutions. The gross profit margins have also improved slightly, thanks to operational efficiencies and better pricing strategies. However, like many tech-driven companies, Shutterstock faces challenges from increased competition and the need to continually innovate.

Overall, the financial trends suggest that Shutterstock is on a stable growth trajectory, with revenues gradually increasing year-over-year. Investors and industry watchers are keeping a close eye on how these numbers evolve, especially in the face of broader economic uncertainties. The good news? The company’s focus on expanding its content library and enhancing customer experience seems to be paying off, positioning it well for future growth.

Growth Drivers and Strategic Initiatives for Shutterstock

So, what’s driving Shutterstock’s growth, and what strategies are they employing to stay ahead? Let’s break down some of the key factors.

1. Expanding Content Offerings: Shutterstock has been heavily investing in increasing its library of images, videos, music, and editorial content. The goal is to become a one-stop shop for all creative needs. By acquiring smaller content providers and forging partnerships, they’re able to offer a broader and more diverse selection to their customers.

2. Embracing Technology and AI: One of Shutterstock’s standout strategies is leveraging artificial intelligence. They’re using AI to improve searchability, recommend personalized content, and even create content. For example, their AI-powered tools help users find the perfect image faster, which enhances user experience and boosts sales.

3. Focus on Enterprise and Custom Solutions: Recognizing the increasing demand from big companies for tailored content, Shutterstock has been ramping up its enterprise offerings. This includes customized licensing options, branded content, and dedicated support. These high-value clients contribute significantly to revenue stability and growth.

4. Geographic Expansion: Shutterstock is not just focusing on North America and Europe; they are actively expanding into emerging markets where digital content consumption is booming. This geographic diversification helps mitigate risks and opens up new revenue streams.

5. Strategic Partnerships and Acquisitions: To accelerate growth, Shutterstock has pursued strategic acquisitions, such as smaller content platforms and technology firms. These moves help enhance their capabilities and expand their customer base.

In summary, Shutterstock’s growth strategy hinges on content diversification, technological innovation, enterprise solutions, and global expansion. By continuously adapting to market trends and investing in new areas, the company aims to solidify its position as a leading player in the digital content industry. If these initiatives succeed, we can expect Shutterstock’s valuation to reflect sustained growth in the coming years.

Market Analysis and Competitor Overview

When we talk about Shutterstock’s place in the digital media and stock content industry, it’s essential to understand the broader market landscape. The stock media market has seen rapid growth over the past few years, fueled by the booming demand for visual content across websites, social media, advertising, and even emerging sectors like virtual reality and augmented reality. This trend isn’t slowing down anytime soon, and Shutterstock is right in the thick of it.

Shutterstock operates in a competitive environment with several key players vying for market share. Some of its main competitors include:

- Getty Images – Known for premium, high-quality content, Getty serves mostly enterprise clients and high-end creative professionals.

- – A subsidiary of Getty, offering more affordable options and a broad range of stock images.

- – Integrated with Adobe Creative Cloud, making it a popular choice for designers and marketers.

- – Focuses on affordability and a vast library, targeting small businesses and individual creators.

Shutterstock’s advantage lies in its extensive library of over 300 million assets, a user-friendly platform, and diversified revenue streams — including images, videos, music, and editorial content. Additionally, its subscription and on-demand licensing models appeal to different customer segments.

However, the industry is evolving rapidly. With new entrants leveraging AI-generated content and niche platforms emerging, Shutterstock must continuously innovate. The company’s ability to adapt to these changing dynamics and maintain its competitive edge will be crucial in determining its future valuation.

Looking ahead, market analysts are optimistic but cautious. The global digital content market is expected to grow at a CAGR (Compound Annual Growth Rate) of around 10% over the next few years, which bodes well for Shutterstock. Still, increased competition and technological shifts mean Shutterstock needs to stay ahead of trends—like AI-driven content creation—to sustain its growth trajectory.

Expert Predictions and Analyst Forecasts for 2025

As we approach 2025, financial experts and industry analysts are sharing their predictions about Shutterstock’s future performance. While forecasting exact numbers can be tricky, the consensus offers some interesting insights.

Many analysts believe Shutterstock will see continued revenue growth driven by several factors:

- Expansion into new markets — Especially in regions like Asia-Pacific, where digital content consumption is booming.

- AI and technology integration — The adoption of AI tools for content creation and curation could lower costs and enhance product offerings.

- Diversification of content types — Growing demand for videos, music, and editorial content expands revenue streams.

Specifically, some forecasts suggest that Shutterstock’s valuation could increase to anywhere between $4 billion to $6 billion by 2025, up from the recent estimates around $3.5 billion. This optimistic outlook hinges on the company’s ability to innovate and capture new customer segments.

Of course, there are also some cautionary notes. Experts highlight potential risks like:

- Intensified competition from both established players and startups using AI-generated content.

- Market saturation – As more companies enter the space, pricing pressures could impact margins.

- Technological disruptions – Rapid changes in AI and machine learning could shift the landscape quickly, requiring constant adaptation.

Overall, most industry insiders are bullish about Shutterstock’s prospects for 2025, provided it continues investing in innovative technology and expanding its global reach. The company’s strategic moves in the next couple of years will be pivotal in shaping its valuation and market position. So, while there’s optimism, stakeholders should keep a close eye on how these forecasts evolve as new developments unfold.

Potential Risks and Challenges Facing Shutterstock

As we look ahead to Shutterstock’s valuation in 2025, it’s important to consider the hurdles that could impact its growth and overall performance. No company is without risks, and Shutterstock certainly faces a few challenges that could influence its market standing.

One of the biggest concerns is intense competition. The digital content marketplace is crowded, with giants like Adobe Stock, Getty Images, iStock, and emerging platforms constantly vying for share. Staying ahead requires continuous innovation, competitive pricing, and maintaining a diverse, high-quality library, which can be resource-intensive.

Another challenge is market saturation. As more users and businesses turn to stock images and videos, the demand might plateau or even decline if new content sources or formats gain popularity. Additionally, the proliferation of free or low-cost alternatives can pressure Shutterstock to keep prices competitive, potentially squeezing profit margins.

Legal and copyright issues also pose risks. Ensuring all content complies with licensing laws and protecting against copyright infringement are ongoing concerns. Any legal missteps or disputes could lead to costly lawsuits or reputational damage.

Furthermore, technological shifts such as advancements in AI-generated content could disrupt traditional stock image models. If AI tools become capable of producing high-quality visuals rapidly and cheaply, Shutterstock may need to adapt swiftly to stay relevant.

Finally, economic fluctuations can influence Shutterstock’s performance. During downturns, companies often cut marketing budgets, reducing their stock content purchases. Global economic instability could slow growth or affect revenue streams.

Conclusion and Future Outlook for Shutterstock’s Worth in 2025

Looking ahead, Shutterstock’s future in 2025 seems promising but not without its uncertainties. The company has built a solid foundation through a vast content library, innovative offerings, and a strong brand presence. These factors position it well to capitalize on the ongoing digital transformation and increasing demand for visual content.

Analysts generally believe that Shutterstock’s adaptability—especially in embracing AI, expanding into new markets, and enhancing user experience—will be key drivers of its valuation growth. If the company continues to innovate and navigate the challenges discussed, it could see a significant increase in its market worth by 2025.

Expected Trends to Watch Include:

- Growth in enterprise and creative professional subscriptions

- Expansion into emerging markets

- Integration of AI and automation for content creation and curation

- Developments in licensing models to diversify revenue streams

In summary, while there are hurdles ahead, Shutterstock’s strategic moves and resilience could lead to a strong valuation in 2025. Investors and industry watchers should keep an eye on how the company adapts to technological innovations, competitive pressures, and market demands. With the right approach, Shutterstock could not only maintain but also enhance its position as a leader in the digital content space in the coming years.