When it comes to setting up an online store, WooCommerce is one of the most popular platforms among entrepreneurs, thanks to its user-friendly interface and extensive customization options. By integrating Stripe as your payment processor, you can make transactions seamless for your customers and efficiently manage your e-commerce operations. But how does this integration work?

WooCommerce is a plugin for WordPress that allows you to transform your website into a fully functional online store. With thousands of themes and plugins available, you can create a unique shopping experience. Stripe, on the other hand, is a powerful payment processor that enables businesses to accept payments over the internet, supporting a wide variety of payment methods, such as credit cards, debit cards, and even mobile wallets.

- Easy Setup: Integrating WooCommerce with Stripe is straightforward. You can install a dedicated Stripe plugin and connect your account within minutes.

- Secure Transactions: Stripe utilizes advanced security measures like tokenization and SSL encryption, ensuring that sensitive customer data is protected.

- Automatic Updates: Both platforms regularly release updates to enhance features and address security concerns, so you can focus on your business.

Ultimately, the combination of WooCommerce and Stripe creates a robust e-commerce environment where you can efficiently manage your online store while ensuring safe and smooth payment transactions.

What are Stripe Fees?

When you start using Stripe for payment processing, it’s essential to understand the fee structure that comes with it to manage your finances effectively. Stripe fees are the costs deducted from your transactions, and knowing these will help you to budget better and set the right pricing strategies for your products or services.

Stripe has a simple, transparent fee structure that consists mainly of:

| Transaction Type | Fee Structure |

|---|---|

| Online Credit and Debit Card Transactions | 2.9% + 30¢ per successful transaction |

| International Cards | 3.9% + 30¢ per successful transaction |

| ACH Direct Debit Transactions | 0.8% per transaction (max $5) |

| Refunds | No refund of initial transaction fee |

Tips to Keep in Mind:

- Stripe fees vary based on your location and payment methods used. Make sure to check the latest fee updates on their official website.

- While Stripe provides powerful tools for managing payments, these fees can add up, especially for businesses with tight margins.

- Consider incorporating Stripe fees into your pricing strategy to maintain profitability without surprising customers.

In summary, understanding Stripe fees is crucial for managing your e-commerce operations effectively. By being aware of the costs associated with transactions, you can plan and budget more efficiently for your online business.

Types of Stripe Fees for WooCommerce

When you integrate Stripe with your WooCommerce store, it’s essential to understand the various types of fees that come along with it. These fees can add up and significantly impact your bottom line, so it’s crucial to be aware of what you’re dealing with. Here’s a quick breakdown of the primary fee types:

- Transaction Fee: This is the fee charged for each successful transaction processed through Stripe. Typically, Stripe charges around 2.9% + 30 cents per transaction, but this can vary based on your location and currency.

- International Fees: If you’re accepting payments from international customers, there might be additional charges. Stripe levies extra fees for currency conversion and international cards, which can be around 1%.

- Refund Fees: If you issue a refund to a customer, Stripe does not return the transaction fee that you initially paid. Essentially, you lose that amount, so it’s something to be mindful of when dealing with returns.

- Chargeback Fees: In case there’s a dispute and a customer files a chargeback, Stripe typically charges a fee (about $15) for managing the process, even if you win the dispute.

These fees can vary, so it’s essential to check the Stripe pricing page for the most up-to-date information based on your particular circumstances. Keeping track of these different fee types will help you maintain a healthier cash flow and set realistic pricing strategies for your products.

How WooCommerce Handles Stripe Fees

Understanding how WooCommerce processes Stripe fees can help you better plan your business strategy. WooCommerce acts as the middleman, connecting your online store to Stripe for easy payment processing. Here’s how it typically works:

- Automated Calculation: Every time a customer makes a purchase, WooCommerce automatically calculates the associated Stripe fees based on the transaction amount and applicable rate.

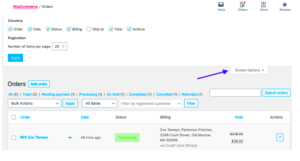

- Fee Visibility: WooCommerce offers tools to track transactions and their respective fees directly from your dashboard. This visibility is vital for managing your finances effectively.

- Impact on Payouts: Stripe fees are automatically deducted from your payout before the funds are transferred to your bank account. So, you’ll receive the net amount after the fees are applied.

- Reporting Capabilities: WooCommerce also provides detailed reports that include information on sales, refunds, and fees incurred, providing a holistic view of your store’s performance.

By leveraging these features in WooCommerce, you can maintain better control over your finances, helping you to plan for expenses and pricing strategies. Remember, being aware of how Stripe fees are applied can save you headaches down the road and enhance your overall business efficiency!

Factors Affecting Stripe Fees in WooCommerce

When you’re running an online store using WooCommerce and processing payments through Stripe, it’s essential to understand that several factors can influence the fees you’ll incur. These fees can add up quickly and impact your bottom line if you’re not careful. Here are some of the primary factors to consider:

- Transaction Amount: The fees charged by Stripe are often a percentage of the transaction amount. So, larger sales will incur higher fees. For example, a 2.9% fee on a $100 sale is $2.90, while on a $10 sale, it’s just $0.29.

- Country of Operation: Stripe fees can vary significantly depending on the country where your business is registered and where your customers are located. Always check the local rates as they may differ.

- Payment Method: Different payment methods (credit cards, debit cards, digital wallets) might carry different transaction fees. Make sure to verify the rates associated with each option.

- Currency Conversion: If you’re dealing with multiple currencies, be aware that currency conversion fees can apply when your customers pay in a currency different from your account’s currency.

- Refunds and Disputes: If you process refunds or face chargebacks, Stripe often charges additional fees for these services, which can further impact your overall costs.

Understanding these factors can help you anticipate your costs and budget accordingly. The more informed you are, the better decisions you can make for your WooCommerce store!

Tips to Minimize Stripe Fees

While Stripe fees are an inevitable part of running your online store, there are several strategies you can implement to help minimize these costs. Let’s dive into some practical tips:

- Higher Average Order Value: Encourage customers to add more items to their cart. By increasing the average order value, the percentage fee may justify itself, reducing the overall cost per transaction.

- Offer Multiple Payment Options: Consider providing various payment methods. Some may carry lower fees than Stripe, giving your customers choices while potentially reducing your overall fees.

- Negotiate Fees: If your business processes a high volume of transactions, reach out to Stripe and discuss the possibility of negotiating lower fees based on your sales volume.

- Automate Refunds and Disputes: Streamlining your refund and dispute processes can help avoid additional fees. Use clear communication to resolve issues before they escalate to chargebacks.

- Monitor Your Transactions: Regularly review your transaction reports to understand your fee structure better. Keeping an eye out for trends can help you identify where to make adjustments.

Implementing these strategies will not only help minimize your Stripe fees but also optimize your overall WooCommerce experience, allowing you to focus on growing your business! Don’t forget, every little bit helps in maximizing your profits!

7. Comparing Stripe Fees with Other Payment Gateways

When it comes to choosing a payment gateway for your WooCommerce store, understanding the fees involved is crucial. Stripe is a popular choice, but how does it stack up against other payment gateways? Let’s break it down.

Firstly, it’s important to note that each payment processor has its own fee structure. Here’s a quick comparison of the typical fees you might encounter:

| Payment Gateway | Transaction Fee | Monthly Fees | Chargeback Fees |

|---|---|---|---|

| Stripe | 2.9% + $0.30 per transaction | None | $15 |

| PayPal | 2.9% + $0.30 per transaction | None | $20 |

| Authorize.net | 2.9% + $0.30 per transaction | $25 | $25 |

| Square | 2.6% + $0.10 per transaction | None | $0 |

As you can see, Stripe generally has a competitive edge, particularly with its straightforward pricing. There are no monthly fees, and while the chargeback fees are common across the board, Stripe offers a good balance of service and cost.

Also, think about the additional features that come with each gateway. For example, Stripe is known for its robust API and seamless integration with WooCommerce—this can save you time and effort in the long run!

In conclusion, while fees are a vital factor, they shouldn’t be the only element guiding your decision. Take into account factors like reliability, customer support, and ease of integration with your WooCommerce setup. An informed choice means assessing the full picture!

8. Conclusion: Making Informed Choices for Your WooCommerce Store

When it comes to setting up your WooCommerce store, understanding payment gateway fees is essential. As we’ve discussed, Stripe’s fee structure is designed to be fair and transparent, but how do you determine if it’s the right fit for your business?

Here are some takeaways to consider:

- Analyze Your Sales Volume: If your store sees high transaction volumes, the percentage fees can add up. Compare these with flat-rate fees of other gateways.

- Evaluate Your Business Model: Different types of businesses may benefit from different gateways. For example, subscription-based models might favor Stripe for its recurring payment features.

- Integration Ease: A payment gateway that integrates seamlessly with WooCommerce saves time and headaches. Look for smooth setups and additional features.

- Customer Support: Reliable customer service is vital. Check reviews and available support options for each gateway.

In the end, it all boils down to making the right choice based on your unique business needs. Stripe may be the best option for many, but others might find better fits in alternatives based on their circumstances. So take your time, do your homework, and select a payment gateway that will not only grow with your business but also enhance customer satisfaction!